Value Creation Model

Capital

Human Capital

- Over 24.7 ths employees

- Women: 76.%

- Master degree: 72.8%

- 35-55 age group: 60.7%

- The Code of Ethics

Capital

Social Capital

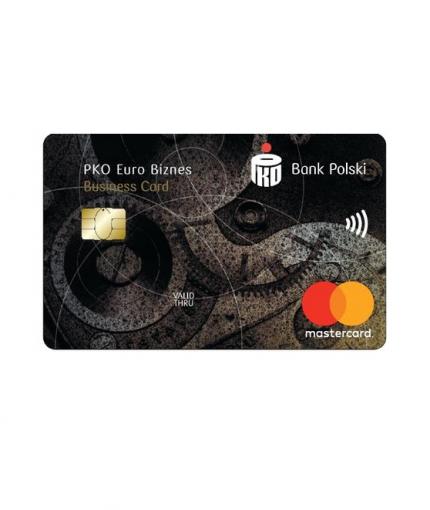

- Strong brand of PKO Bank Polski SA

- Reputation of the Bank with the 100-year history

- Sponsorship budget

- Charity budget (nearly PLN 18mn) – the PKO Bank Polski Foundation

- Active relationship with all the stakeholders

Capital

Financial Capital

- Assets: PLN 278 bn (Bank)

- Equity: PLN 36 bn

Capital

Natural Capital

- Resources of fuel, gas, electricity, water, paper

Capital

Intellectual Capital

- Organizational capital

- an integrated model of development of the Group

- policies, procedures

- Strategy 2016-2020

- IT resources

- Ability to develop innovative products

Capital

Manufactured Capital

- 14 direct subsidiaries

- Dense network of units (1937 branches and agencies)

Our activities

Loans and advances,

Investment securities,

Financial instruments,

Amounts due from banks,

Other services

Our activities

Loans and advances,

Investment securities,

Financial instruments,

Amounts due from banks,

Other services

Our resources

Deposits,

Equity,

Debt securities,

Amounts due to banks,

Other: IT, employees,

branch network

Our resources

Deposits,

Equity,

Debt securities,

Amounts due to banks,

Other: IT, employees,

branch network

Our priorities

Customer experience,

Optimization of capital management,

Increase in cost efficiency and organizational efficiency,

Regulatory and cyber security,

Digital transformation

Our priorities

Customer experience,

Optimization of capital management,

Increase in cost efficiency and organizational efficiency,

Regulatory and cyber security,

Digital transformation

Capital

Human Capital

- Over 58k participants of training organized by the Bank (2 courses per 1 employee)

- Over 146k participants of training in the e-learning formula

- 1,165 participants of training from the list of training sessions

- 4.9% increase in employee benefits

- 98% of employees covered by medical packages

- 71% of employees covered by employee pension programme

- 16% of employees having cards to sports facilities

- 16% of employees - trade union members

- Average salary: PLN 6,040

- Ratio of women’s salaries to men’s

- the branches: significantly above the national average (84%)

- directors: 95%

- managers: 96%

- other employees: 91%

- other units: levels close to the national average (84%)

- directors: 84%

- managers: 84%

- other employees: 75%

- the branches: significantly above the national average (84%)

- Employee complaints

- 7 concerning mobbing, not confirmed in 4 cases, 3 of them still being reviewed

- 1 concerning discrimination

Capital

Social Capital

- 9.5mn of retail customers; nearly 15k of corporate and investment customers

- 96% of customers satisfied with onlinebanking services offered under the iPKO brand

- 94% of customers satisfied with mobile applikaction IKO

- 87% of customers appreciating the work of consultants Contact Center

- Wide-ranging education, including the financial one

- 294k PKO Konto Dziecka [PKO Child’s Account] accounts

- 152k SKO Konto dla Ucznia [School Savings Pupil’s Accounts] accounts

- 321 sponsorship projects

- 513 charity projects

- 184k runners taking part in sponsored running races

- 1365 active volunteers from among the employees of the Bank

- 830 l blood collected during the Banking Blood Donation Action

- 6,150 children participating in Integration Santa Clause Meetings

- Over PLN 2.6bn of taxes paid

- Credits of a social nature

- Nearly 10% of the loan portfolio to the sector of business and public entities provided to entities from sectors of a social nature (public administration, health, culture and entertainment)

- 4.8k MdM [Housing for the Young] credits

- PLN 847mn of preferential student loans

- 4.1k - the average monthly number of publications concerning the Bank

Capital

Financial Capital

- Sound capital position: 18.62% Tier 1

- Value for shareholders: PLN 2.8bn net profit (PLN 3.1bn net profit of the Group)

- An increase in revenues: PLN 11.2bn result on business activity

- Efficient operations: cost to income ratio (C / I) at 44.8%

Capital

Natural Capital

- Consumption of

- gas: 1,689k m3 (-7%)

- heating oil: 404 m3 (-6%)

- coal: 43t (+8%)

- fuel: 2,683k l (+1%)

- electricity: 74,948 kWh (-8%)

- paper: 500k reams (-7%)

- Production of waste other than municipal waste: 850t (+9%)

- Financing of

- LAUs (local authority units), including ecological projects: 11.4% of the total amount of financing of business and public entities (including loans and debt securities)

- Investments in generation of energy from renewable sources, discharge and treatment of sewage, managing waste and reclamation: 0.9% of the total amount of financing of business and public entities

- the mining sector in gradually declining proportion: 1.9% of the loan portfolio of business and public entities (2.3% at the end of 2016)

Capital

Intellectual Capital

- Security of customer funds and privacy

- Start-up acceleration program

- Innovative solutions

- BLIK payment system, which became the Polish market standard

- 3.8mn active users of internet banking

- Over 2mn users of IKO mobile application

- PKO Junior transaction service

- start-up fintech

- biometrics

- e-government services (500+, Trusted Profile, possibility to register firms in CEIDG (the Central Records and Information on Business Activity), an application to conduct PIT settlement)

Capital

Manufactured Capital

- Retail segment (the Group)

- loans volume: PLN 157bn

- deposits volume: PLN 167bn

- Corporate and investment segment (the Group)

- loans volume: PLN 64bn

- deposits volume: PLN 49bn

- The PKO Bank Polski SA Group’s market shares:

- 17,7% of loan market

- 17,9% of deposit market

- 12% of lease market

- 14,7% of secondary stock market

- 17,2% of non-dedicated investment funds market

Strategy 2016 – 2020

In progressBusiness model expansion

PKO Bank Polski improved its position in the strategic segment of small and medium enterprises by means of e.g. the acquisition of Raiffeisen Leasing Polska.

The fast organic development of PKO TFI and the acquisition of KBC TFI improved the position of the PKO Bank Polski Group in the segment of investment funds. In 2017, the Group achieved a growth in investment fund assets of more than 50%.

PKO Bank Hipoteczny is currently the largest and most active issuer of mortgage bonds in Poland. The total value of mortgage bonds issued and outstanding as at the end of 2017 was close to PLN 9 bn.

Discover moreIn progressClose to the customer

The Bank took measures focused on building positive customer experience and closer relations with its customers. These measures included strategic initiatives aimed at developing customer-oriented solutions, standardizing the services provided through various channels, and digitizing the sales and service processes.

The management of customer relations is supported by investments in the modern CRM, which is a tool used by advisors, agents and the Contact Center. The CRM for corporate banking, which is currently being implemented, will guarantee a new quality of service for corporate customers.

The implementation of a business model, with a product and price offer tailored to the needs of companies, is a task for the newly formed Corporate Banking Centre. With a dedicated service model, PKO Bank Polski will be able to improve its market position in the segment of enterprises with revenues in the range of PLN 5–30 million.

To improve relations with corporate and institutional customers, PKO Bank Polski launched a modern online banking platform iPKO biznes, which (in addition to an updated graphic design) has some new functions. The online platform is supplemented with a mobile application for corporate customers. Furthermore, a multi-currency cash pooling system was implemented. It is the first solution of this type in Poland.

A newly opened branch in the Czech Republic, which is another branch located outside Poland after the one in Frankfurt, offers the Bank’s customers new opportunities for establishing business relations. Discover moreIn progressDistribution excellence

The IKO application and its more than 2,300k users prove that the modern digital solutions implemented by PKO Bank Polski meet customer expectations. In the mobile application ranking published by the Retail Banker International monthly, IKO took first place among the applications offered by 100 banks from all over the world.

PKO Bank Polski launched the “Laboratory Branch” project to test innovative solutions aimed at improving customer service at the Bank’s branches in the real-life environment.

Work on the implementation of a new format of the Bank’s branches is under way. The project includes e.g. re-arrangement of the branches’ appearance, testing of new technological solutions aimed at improving customer service, customer identification and transaction approval.

The construction of the new Warsaw Rotunda entered a new stage. The steel structure surmounted with beams arranged in a characteristic zigzag pattern is ready.

Discover moreIn progressOperational efficency

The Bank commenced a project for the digitization of sales and service processes, which consists of three streams: paperless, channels, automation and robotics. The project will use so-called agile work methods. The adaptation of paperless solutions contributes to significant savings of the costs of paper and enhances our image as an environmentally-friendly organization.

The Bank invests in modern data analytics and Big Data competencies. It has also commenced building an innovative IT platform supporting the analytical processes at the Bank in order to deal with actual business challenges.

Discover moreIn progressModern organization

PKO Bank Polski SA received the Solid Employer of the Year 2017 title in the banking sector. Our practices and solutions in the area of human resources management obtained high evaluations.

In 2017, large training and development projects were carried out. The New Business Partnership Model and the Contact Center HR dedicated to the Bank’s employees were implemented.

Discover moreIn progressInnovation and technology

PKO Bank Polski improves customer service processes. With the use of modern solutions, business can be run from home. The Bank’s customers may now register their firms with CEIDG (Central Registration and Information on Business) through the iPKO online banking platform. It is the first solution of this type implemented on the Polish market and, at the same time, a breakthrough in e-administration.

The Bank works closely with government administration on promoting e-State services, which make things easier for millions of citizens and firms. The new opportunities are known as the “trusted profile”, which provides verified access to public administration platforms.

The Bank constantly invests in innovation and technologies. Such projects include the acceleration programme for start-ups, “Let’s Fintech with PKO Bank Polski”, biometrical solutions, or a direct investment in the start-up Zencard.

Customers of PKO Bank Polski have been offered an opportunity to exchange currencies through the iPKO online platform, with the use of the new PKO Bank Polski’s “Online Currency Exchange”.

The Bank was the first Polish financial institution to start testing blockchain solutions.

Discover moreBusiness model expansion

Market

Increasing the market reach

- Domestic acquisitions

- Market monitoring

- The potential targets of acquisitions will depend on the situation of the bank owners and their strategies regarding the maintenance of their commitment to Poland

- Lower share prices of the banks due to the low interest rate environment, regulatory changes, the problem of FX mortgages, slower market growth

- Current slow-down in the consolidation trends, but further industry consolidation expected in the long run

- Synergies

- The Bank will provide operational and capital support and distribution within the Capial Group

- Realization of synergies within the Capial Group

- Strengthening of the position

- Complementation of the distribution network

- Strengthening of competencies

Abroad

Expansion abroad supporting the customers’expansion

- Directions set by the needs of customers

- Support directed from Poland

- Representative offices

- Foreign branches

- Acquisitions

- Reaching No. 1 position in Correspondent Banking

- Expansion of the international clearing infrastructure enabling an effective funds transfer to/from anywhere in the world (observing the applicable restrictions and international treaties)

- Professional service for foreign and domestic banks, including acting as a correspondent bank in international clearing, expansion of the range of currencies

- Support for export and expansion by Polish companies

- Development of instruments hedging our customers against risks involved in export and expansion abroad:

- risk mitigation in international trade

- market risk mitigation

- Financing our customers’ foreign operations based on long-term local relationships with customers and providing export within the framework of the existing governmental projects

- Development of instruments hedging our customers against risks involved in export and expansion abroad:

Alliances

- Loyalty platforms

- Creation of loyalty platforms adding value to selected customer segments, e.g. in the form of discounts for daily shopping

- Partnerships with retailers, clothing and fuel companies, postal service providers, etc. interested in the development of their sales channels in cooperation with the Bank

- Open APIs

- Deepening and expanding business with Corporate and SME customers

- Cooperation with public institutions such as the Social Security Administration (ZUS) and Tax Office on eState solutions

- Business relations with the suppliers of niche added services

- Strategic partnership

- Establishment of business relations with smaller undertakings from the financial, quasi-financial and technology sectors

- Investments in selected fintech undertakings in order to achieve the leading position in technological solutions

Innovations

- Payments

- Development of the BLIK application and the acquiring network

- Monitoring of trends and identification of potential fintech partners

- eIdentity

- Promoting the concept of e-identity with the leading role of the Bank in the ecosystem

- Supporting the State and local governments in financing and implementing e-identity

- Looking for strategic partners to cooperate with

- Capital markets

- Enhancing the extent of use of investment products by SME and Corporate customers

- Development of products for customers operating abroad (e.g. interest rate and FX risks management)

- Wealth management

- New model of offering of investment, savings and insurance products

- Advisory services using advanced algorithms (roboadvisory)

- A tool to support savings planning at every stage of the customer’s life

- Internet of Things Blockchain

- Trend analysis, including the possibility of employment of sensors, data carriers and WIFI in solutions for the customers. Development of smartwatch apps

- Analysis of the possibility of use of the Blockchain