Consolidated income statement

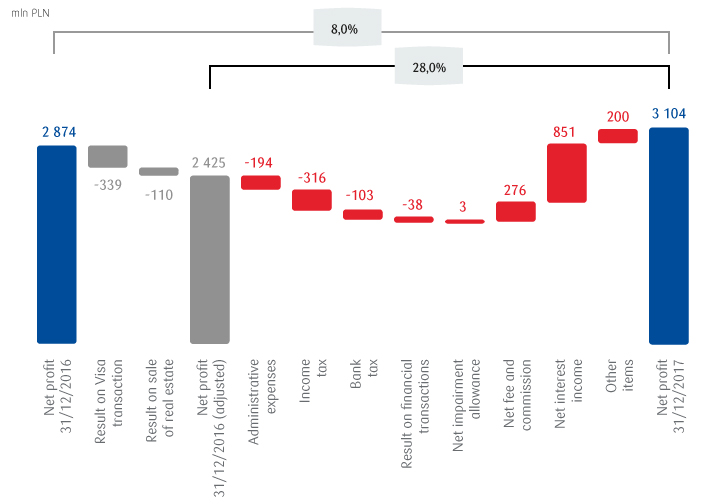

The consolidated net profit of the PKO Bank Polski SA Group achieved in 2017 amounted to PLN 3,104 million and was PLN 230 million (+8.0%) higher than in 2016.

In the income statement of the PKO Bank Polski SA Group for 2017, the result on business activity amounted to PLN 12,563 million and was PLN 773 million, i.e. 6.6% higher than in 2016, mainly due to an increase in net interest income and net commission income.

Income statement of the PKO Bank Polski SA Group (in PLN million)

| 2017 | 2016 | Change (in PLN million) | Change (in %) | |

| Net interest income | 8 606 | 7 755 | 851 | 11,0% |

| Net fee and commission income | 2 969 | 2 693 | 276 | 10,2% |

| Net other income | 988 | 1 342 | -354 | -26,4% |

| Dividend income | 12 | 10 | 2 | 20,0% |

| Net income on financial operations | 54 | 510 | -456 | -89,4% |

| Foreign exchange result | 452 | 503 | -51 | -10,1% |

| Net other operating income and expenses | 470 | 319 | 151 | 47,3% |

| Result on business activities | 12 563 | 11 790 | 773 | 6,6% |

| General administrative expenses | -5 784 | -5 590 | -194 | 3,5% |

| Tax on some financial institutions | -932 | -829 | -103 | 12,4% |

| Net operating profit/(loss) | 5 847 | 5 371 | 476 | 8,9% |

| Net impairment allowance and write-downs | -1 620 | -1 623 | 3 | -0,2% |

| Share in profits and losses of associates and joint ventures | 22 | 35 | -13 | -37,1% |

| Profit before tax | 4 249 | 3 783 | 466 | 12,3% |

| Corporate income tax | -1 140 | -907 | -233 | 25,7% |

| Net profit (including non-controlling interests) | 3 109 | 2 876 | 233 | 8,1% |

| Profits (loss) attributable to non-controlling shareholders | 5 | 2 | 3 | 2,5x |

| Net profit for the year | 3 104 | 2 874 | 230 | 8,0% |

After eliminating the most significant one-off events from 2016, including:

- the settlement of the acquisition of Visa Europe Limited by Visa Inc., in which PKO Bank Polski SA took part; its effect on the Bank’s results amounted to PLN 339 million;

- the settlement of the sale of assets of Qualia Development Sp. z o.o. and its subsidiaries (PLN 110 million); as a result, the Group recognized additional income of approx. PLN 114 million in net other operating income and expenses;

net profit in 2017 was 28% higher than in 2016.

Income statement of the PKO Bank Polski SA Group (in PLN million), excluding one-off events

| 2017 | 2016 | eliminations | 2016 after eliminations | Change (in PLN million) | Change (in %) | |

| Net interest income | 8 606 | 7 755 | 7 755 | 851 | 11,0% | |

| Net fee and commission income | 2 969 | 2 693 | 2 693 | 276 | 10,2% | |

| Net other income | 988 | 1 342 | 532 | 810 | 178 | 22,0% |

| Dividend income | 12 | 10 | 10 | 2 | 20,0% | |

| Net income on financial operations | 54 | 510 | 418 | 92 | -38 | -41,3% |

| Foreign exchange result | 452 | 503 | 503 | -51 | -10,1% | |

| Net other operating income and expenses | 470 | 319 | 114 | 205 | 265 | 2,3x |

| Result on business activities | 12 563 | 11 790 | 532 | 11 258 | 1 305 | 11,6% |

| General administrative expenses | -5 784 | -5 590 | -5 590 | -194 | 3,5% | |

| Tax on some financial institutions | -932 | -829 | -829 | -103 | 12,4% | |

| Net operating profit/(loss) | 5 847 | 5 371 | 532 | 4 839 | 1 008 | 20,8% |

| Net impairment allowance and write-downs | -1 620 | -1 623 | -1 623 | 3 | -0,2% | |

| Share in profits and losses of associates and joint ventures | 22 | 35 | 35 | -13 | -37,1% | |

| Profit before tax | 4 249 | 3 783 | 532 | 3 251 | 998 | 30,7% |

| Corporate income tax | -1 140 | -907 | -83 | -824 | -316 | 38,3% |

| Net profit (including non-controlling interests) | 3 109 | 2 876 | 449 | 2 427 | 682 | 28,1% |

| Profits (loss) attributable to non-controlling shareholders | 5 | 2 | 2 | 3 | 2,5x | |

| Net profit for the year | 3 104 | 2 874 | 449 | 2 425 | 679 | 28,0% |

Net interest income

Net interest income generated in 2017 amounted to PLN 8,606 million and was PLN 851 million higher than in the prior year. The improvement was due to an increase in income related to the increase in the loan portfolio and the securities portfolio, accompanied by increased borrowing costs.

Interest income (in PLN million)

In 2017, interest income amounted to PLN 10,919 million and was PLN 954 million higher than in the prior year, mainly as a result of an increase in:

- income from loans and advances to customers of PLN 819 million y/y – resulting from an increase in an average volume of lease and loan receivables, mainly housing and consumer loans, with unchanged levels of market interest rates for PLN, CHF and EUR;

- income from securities of PLN 143 million y/y, resulting from an increase in the portfolio of securities (mainly Treasury bonds) and an increase in their average interest rates in connection with an increased share of longer-term securities in the portfolio.

Interest expense in 2017 amounted to PLN 2,313 million and was PLN 103 million higher than in 2016, which was due to:

- higher own issue costs of debt securities and subordinated liabilities of PLN 69 million y/y, resulting from an increased level of issued medium-term bonds and mortgage bonds;

- an increase in costs related to amounts due to customers of PLN 46 million y/y, resulting from an increase in deposits with slightly lower average interest rates, which was due to an increased share of current deposits in the total deposits;

- higher costs of amounts due to banks of PLN 34 million y/y, related to increased costs of servicing loans received from financial institutions, accompanied by a lower volume of loans received, mainly due to considerable early repayment of a credit line from Nordea Bank AB.

Interest margin increased by ca. 0.1 p.p. y/y to 3.3% as at the end of 2017. Average interest-bearing assets increased by 5.7% y/y (mainly in the portfolio of amounts due from customers and the securities portfolio), whereas net interest income increased by 11.0%, mainly due to an increase in interest income on loans and securities (the effect of an increased volume and profitability of assets).

In 2017, an average interest rate on loans of the PKO Bank Polski SA Group amounted to 4.3% and an average interest rate on deposits amounted to 0.8%, compared with 4.1% and 0.8% respectively in 2016.

Net fee and commission income

Net fee and commission income in 2017 amounted to PLN 2,969 million and was PLN 276 million higher than in the prior year.

The level of net commission income was largely determined by:

- a higher net commission income on maintaining of investment funds (PLN 109 million y/y), resulting from higher customer interest in this form of saving. This translated into higher income from management commission and fees for unit distribution, accompanied by an increase in the value of managed asset of PKO TFI SA of 29.1% compared with the end of 2016;

- a higher net commission income on loan insurance (PLN 62 million y/y), resulting mainly from increased sales of insurance products linked with consumer loans and advances and lease receivables;

- a higher net commission income on brokerage activities (PLN 46 million y/y), resulting from an increased commission on stock exchange trading due to the improved situation on the WSE. The turnover of Dom Maklerski PKO Banku Polskiego SA on the secondary market of shares in 2017 represented 14.7% of the market’s turnover, placing Dom Maklerski on the first position in the ranking of brokerage houses as at the end of 2017. Moreover, there was an increase in income from handling transactions executed on the primary market and an increase in commission for acting as an issuing agent of Treasury bonds as a result of increased interest of the customers in this form of investment;

- a higher net commission income on loans granted (PLN 30 million y/y), mainly housing and consumer loans;

- a higher net commission income on payment and credit cards (PLN 29 million y/y), as a result of a higher number of cards and a higher level of non-cash transactions.

Net fee and commission income (in PLN million)

Net other income

In 2017, net other income amounted to PLN 988 million and went down by PLN 354 million compared with the prior year.

The level of net other income was largely determined by:

- a decrease in net income on investment securities of PLN 460 million y/y, which was due to settling in June 2016 of an acquisition of Visa Europe Limited by Visa Inc. in which PKO Bank Polski SA participated; on this account the Bank recorded an amount approaching PLN 418 million in the result on financial transactions;

- an increase in net income on other operating activities of PLN 151 million, mainly as a result of developing the operations of insurance companies (PKO Życie Towarzystwo Ubezpieczeń SA and PKO Towarzystwo Ubezpieczeń SA) and a higher contribution of the lease activities.

Net other income (in PLN million)

General administrative expenses

In 2017, general administrative expenses amounted to PLN 5,784 million and were 3.5% higher than in the similar period of the prior year.

Their level was mainly influenced by an increase in:

- employee benefits of PLN 138 million, i.e. 4.9%;

- amortization and depreciation of PLN 43 million, i.e. 5.4%;

- and taxes and fees (of PLN 87 million, i.e. 126.1%);

accompanied by a decrease in:

- contributions and payments to the BGF of PLN 37 million y/y, i.e. 8.4% (including PLN 24 million relating to the mandatory payment designated for payment of amounts guaranteed to deponents in connection with the bankruptcy of Bank Spółdzielczy in Nadarzyn carried out in 2016);

- sundry costs of PLN 13 million, i.e. 0.9%.

Administrative expenses (in PLN million)

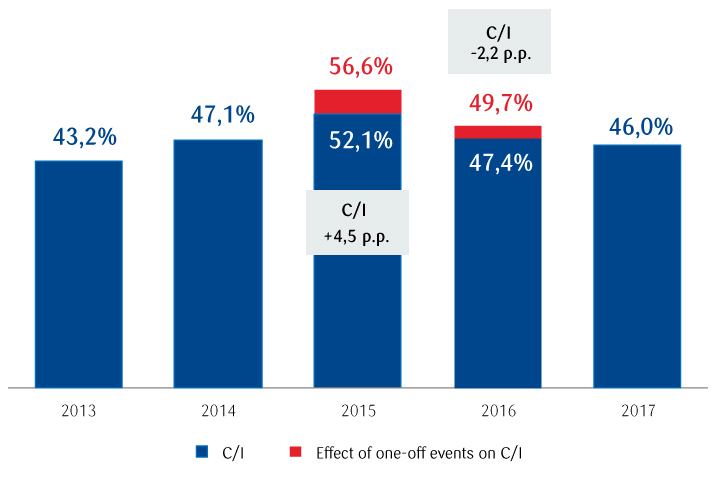

C/I ratio of PKO Bank Polski SA Group

The operating effectiveness of the PKO Bank Polski SA Group measured with the C/I ratio in annual terms amounted to 46.0% and improved by 1.4 p.p. y/y thanks to an improved result on business activities (+6.6% y/y), accompanied by an increase in administrative expenses (+3.5% y/y).

Tax on some financial institutions

From February 2016, banks and other financial institutions are obliged to pay tax on some financial institutions. The charge to the Bank’s Group on account of this tax in 2017 amounted to PLN 932 million, of which the majority was payable by PKO Bank Polski SA (PLN 894 million).

Net impariment allowance and write-downs

Net impairment allowance and write-downs reflects the PKO Bank Polski SA Group’s conservative approach to recognition and measurement of credit risk. Net impairment allowance was maintained on a similar level (-0.2% y/y) thanks to the improvement of the allowance on the housing loan portfolio.

The share of impaired loans and coverage of loans with recognized impairment as at the end of 2017 amounted to 5.5% (up by 0.4 p.p. compared with 2016) and 67.0% (up by 1.5 p.p. compared with 2016), respectively. This was due to an improvement of the quality of business loans and the consistent policy of selling irregular receivables.

The cost of risk1 as at the end of 2017 amounted to 0.71% and was improved by 0.04 p.p. compared with 2016 thanks to an improved result on housing and business loans.

1. Calculated by dividing net impairment allowances on loans and advances to customers for the 12 months ended 31 December 2017 and 2016 by the average balance of gross loans and advances to customers at the start and end of the reporting period and interim quarterly periods.

Net imparirment allowance on loans of PKO Bank Polski SA Group (in PLN million)

Consolidated income statement - details

| Note | 2017 | 2016 | |

| Interest and similar income | 7 | 10 919 | 9 965 |

| Interest expenses and similar charges | 7 | (2 313) | (2 210) |

| Net interest income | 8 606 | 7 755 | |

| Fee and commission income | 8 | 3 918 | 3 579 |

| Fee and commission expense | 8 | (949) | (886) |

| Net fee and commission income/(expense) | 2 969 | 2 693 | |

| Dividend income | 9 | 12 | 10 |

| Net gain/(loss) on financial instruments measured at fair value | 10 | 8 | 4 |

| Gain/(loss) on investment securities | 11 | 46 | 506 |

| Net foreign exchange gains/(losses) | 12 | 452 | 503 |

| Other operating income | 13 | 710 | 649 |

| Other operating expenses | 13 | (240) | (330) |

| Net other operating income and expenses | 470 | 319 | |

| Net impairment allowances and provisions | 14 | (1 620) | (1 623) |

| Administrative expenses | 15 | (5 784) | (5 590) |

| Tax on certain financial institutions | 16 | (932) | (829) |

| Operating profit/(loss) | 4 227 | 3 748 | |

| Participation in profits/ (losses) of associates | 22 | 35 | |

| Profit before income tax | 4 249 | 3 783 | |

| Income tax expense | 17 | (1 140) | (907) |

| Net profit (including non-controlling shareholders) | 3 109 | 2 876 | |

| Profit (loss) attributable to non-controlling shareholders | 5 | 2 | |

| Net profit attributable to the equity holders of the parent company | 3 104 | 2 874 | |

| Earnings per share | 18 | ||

| – basic earnings per share for the period (PLN) | 2,48 | 2,30 | |

| – diluted earnings per share for the period (PLN) | 2,48 | 2,30 | |

| Weighted average number of ordinary shares during the period (in million) | 1 250 | 1 250 | |

| Weighted average diluted number of ordinary shares during the period (in million) | 1 250 | 1 250 |

Consolidated statement of comprehensive income

| Note | 2017 | 2016 | |

| Net profit (including non-controlling shareholders) | 3 109 | 2 876 | |

| Other comprehensive income | 578 | (572) | |

| Items which may be reclassified to profit or loss | 577 | (574) | |

| Cash flow hedges (gross) | 23 | (8) | (63) |

| Deferred tax on cash flow hedges | 17, 23 | 1 | 12 |

| Cash flow hedges (net) | 23 | (7) | (51) |

| Remeasurement of available-for-sale financial assets (gross) | 761 | (636) | |

| Deferred tax on available-for-sale financial assets | 17 | (142) | 118 |

| Unrealized net gains on available-for-sale financial assets (net) | 619 | (518) | |

| Foreign exchange differences on translation of foreign branches | (36) | (4) | |

| Share in other comprehensive income of associates and joint ventures | 1 | (1) | |

| Items which cannot be reclassified to profit or loss | 1 | 2 | |

| Actuarial gains and losses (gross) | 1 | 2 | |

| Actuarial gains and losses (net) | 1 | 2 | |

| Total net comprehensive income | 3 687 | 2 304 | |

| Total net comprehensive income, of which attributable to: | 3 687 | 2 304 | |

| equity holders of PKO Bank Polski SA | 3 682 | 2 302 | |

| non-controlling shareholders | 5 | 2 |