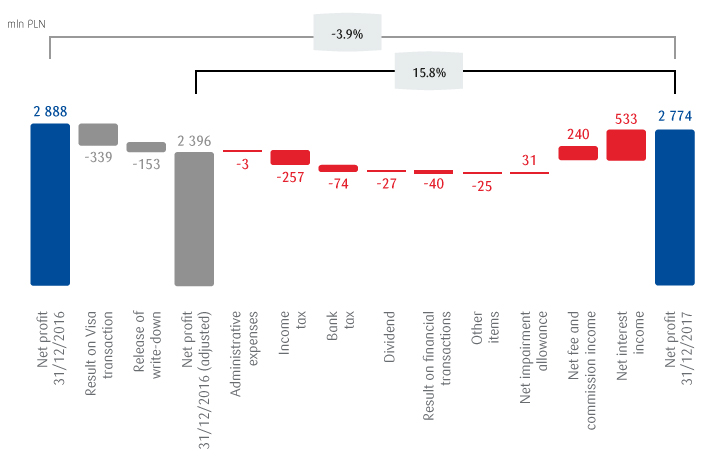

In 2017, PKO Bank Polski SA generated a net profit of PLN 2,774 million (-3.9% y/y, i.e. PLN 114 million lower), which was mainly due to a lower result on financial transactions and lower net impairment allowances, partly offset by higher net interest income and net commission income.

The result on business activities in the income statement of PKO Bank Polski SA for 2017 amounted to PLN 11,246 million and was PLN 263 million, i.e. 2.4% higher than in 2016, mainly as a result of an increase in net interest income of PLN 533 million y/y and net fee and commission income of PLN 240 million y/y, accompanied by a decrease of the result on financial transactions of PLN 458 million y/y.

Income statement of PKO Bank Polski SA (in PLN million)

| 2017 | 2016 | Change (in PLN million) | Change (in %) | |

|---|---|---|---|---|

| Net interest income | 7.901 | 7.368 | 533 | 7,2% |

| Net fee and commission income | 2.687 | 2.447 | 240 | 9,8% |

| Net other income | 658 | 1.168 | -510 | -43,7% |

| Dividend income | 135 | 162 | -27 | -16,7% |

| Net income on financial operations | 47 | 505 | -458 | -90,7% |

| Foreign exchange result | 419 | 501 | -82 | -16,4% |

| Net other operating income and expenses | 57 | 0 | 57 | x |

| Result on business activities | 11.246 | 10.983 | 263 | 2,4% |

| General administrative expenses | -5.037 | -5.034 | -3 | 0,1% |

| Tax on some financial institutions | -894 | -820 | -74 | 9,0% |

| Net operating profit/(loss) | 5.315 | 5.129 | 186 | 3,6% |

| Net impairment allowance and write-downs | -1.530 | -1.408 | -122 | 8,7% |

| Profit before tax | 3.785 | 3.721 | 64 | 1,7% |

| Corporate income tax | -1.011 | -833 | -178 | 21,4% |

| Net profit for the year | 2.774 | 2.888 | -114 | -3,9% |

After eliminating the most significant one-off events from 2016, including:

- the settlement of the acquisition of Visa Europe Limited by Visa Inc., in which PKO Bank Polski SA took part and recording its effect on the Bank’s results in an amount of PLN 339 million;

- releasing an allowance for the exposure in Qualia Development Sp. z o.o. of PLN 153 million in connection with reviewing the fair value of the exposure;

net profit in 2017 was 15.8% higher than in 2016.

Income statement of PKO Bank Polski SA (in PLN million), excluding one-off events

| 2017 | 2016 | eliminations | 2016 after eliminations | Change (in PLN million) | Change (in %) | |

|---|---|---|---|---|---|---|

| Net interest income | 7.901 | 7.368 | 7.368 | 533 | 7,2% | |

| Net fee and commission income | 2.687 | 2.447 | 2.447 | 240 | 9,8% | |

| Net other income | 658 | 1.168 | 418 | 750 | -92 | -12,3% |

| Dividend income | 135 | 162 | 162 | -27 | -16,7% | |

| Net income on financial operations | 47 | 505 | 418 | 87 | -40 | -46,0% |

| Foreign exchange result | 419 | 501 | 501 | -82 | -16,4% | |

| Net other operating income and expenses | 57 | 0 | 0 | 57 | x | |

| Result on business activities | 11.246 | 10.983 | 418 | 10.565 | 681 | 6,4% |

| General administrative expenses | -5.037 | -5.034 | -5.034 | -3 | 0,1% | |

| Tax on some financial institutions | -894 | -820 | -820 | -74 | 9,0% | |

| Net operating profit/(loss) | 5.315 | 5.129 | 418 | 4.711 | 604 | 12,8% |

| Net impairment allowance and write-downs | -1.530 | -1.408 | 153 | -1.561 | 31 | -2,0% |

| Profit before tax | 3.785 | 3.721 | 571 | 3.150 | 635 | 20,2% |

| Corporate income tax | -1.011 | -833 | -79 | -754 | -257 | 34,2% |

| Net profit for the year | 2.774 | 2.888 | 492 | 2.396 | 378 | 15,8% |

Net interest income

Net interest income generated in 2017 amounted to PLN 7,901 million and was PLN 533 million higher than in the prior year. The improvement was due to an increase in income related to the increase in the loan portfolio and the securities portfolio, accompanied by a slight increase in borrowing costs.

Interest income (in PLN million)

Interest income in 2017 amounted to PLN 10,075 million and was 6.2% higher than in 2016, which is mainly due to an increase in:

- income from loan and advances to customers (PLN +352 million, i.e. +4.5% y/y) an increase in the average interest rates on the portfolio of loans, arising from positive changes in the structure of the loans (an increase in the share of consumer loans having the highest interest rates) and an increase in the average volume of amounts due from customers, realized in spite of transferring a considerable portfolio of housing loans to Bank Hipoteczny (with a value of approx. PLN 5.6 billion in 2017);

- income from securities of PLN 137 million y/y, resulting from an increased volume of the portfolio of securities (mainly Treasury bonds) and an increase in their average interest rates in connection with an increased share of longer-term securities in the portfolio,

- accompanied by an increase in income from derivative hedging instruments (PLN +60 million y/y), mainly as a result of a higher volume and average interest rate on CIRS hedging transactions.

Interest expense in 2017 amounted to PLN 2,174 million and was 2.8% higher than in 2016, which was mainly due to an increase in:

- an increase in the costs related to amounts due to customers of PLN 85 million y/y, arising from an increase in the costs of customer deposits related to an increase in an average volume of customer deposits and their lower average interest rate – being an effect of changes in the structure of deposits (a higher share of current deposits) and higher costs of financing obtained from non-monetary financial institutions;

- an increase in the costs related to amounts due to banks of PLN 21 million, related to higher costs of servicing the loans received from monetary financial institutions,

- accompanied by a decrease in the costs of premium on securities of PLN 45 million.

In 2017, an average interest rate on loans of PKO Bank Polski SA amounted to 4.2% and an average interest rate on total deposits amounted to 0.8%, compared with 4.1% and 0.8% respectively in 2016.

Interest margin increased by ca. 0.1 p.p. y/y to 3.2% as at the end of 2017. The increase in average assets of 2.3% y/y (mainly the securities portfolio and the portfolio of amounts due from customers) was accompanied by an increase in net interest income of 7.2%, which arose mainly from an increase in interest income on loans and securities (related to an increased volumes and interest rates in these groups of assets).

Average interest on loans

Net fee and commission income

Net commission income in 2017 amounted to PLN 2,687 million and was PLN 240 million higher than in the prior year.

The level of net fee and commission income in 2017 was mainly affected by the following factors:

- a higher net commission income on maintaining of investment funds (PLN 116 million y/y), resulting from higher customer interest in this form of saving. This translated into higher income from management commission and fees for unit distribution, accompanied by an increase in the value of managed asset;

- a higher net commission income on loan insurance (PLN 45 million y/y), resulting mainly from increased sales of insurance products linked with consumer loans and advances;

- a higher net commission income on brokerage activities (PLN 46 million y/y), resulting from an increased commission on stock exchange trading due to the improved situation on the WSE – the turnover of Dom Maklerski PKO Banku Polskiego SA on the secondary market of shares in 2017 represented 14.7% of the market’s turnover, placing Dom Maklerski on the first position in the ranking of brokerage houses as at the end of 2017. Moreover, there was an increase in income from handling transactions executed on the primary market and an increase in commission for acting as an issuing agent of Treasury bonds as a result of increased interest of the customers in this form of investment;

- a higher net commission income on payment and credit cards (PLN 26 million y/y), as a result of a higher number of cards and a higher level of non-cash transactions;

- a higher net commission income on loans granted (PLN 23 million y/y), mainly consumer and housing loans;

- a lower net income on handling bank accounts and net other income (PLN -18 million y/y), related to a change in the account structure of those customers who decide to have accounts with lower maintenance fees.

Net fee and commission income (in PLN million)

Net other income

Net other income generated in 2017 amounted to PLN 658 million and was PLN 510 million lower than that generated in 2016. The amount of the net income for 2017 was mainly affected by a decrease in net income on investment securities (PLN -461 million y/y), which was due to the settlement (in June 2016) of the acquisition of Visa Europe Limited by Visa Inc., in which PKO Bank Polski SA participated; on this account the amount of PLN 418 million was recognized in the Bank’s result.

Net other income (in PLN million)

General administrative expenses

In 2017, general administrative expenses amounted to PLN 5,037 million and were 0.1% higher y/y. Their level was mainly influenced by:

- an increase in employee benefits of PLN 64 million, i.e. 2.5%;

- an increase in amortization and depreciation of PLN 5 million, i.e. 0.7%;

- a decrease in contributions and payments to the BGF of PLN 57 million, i.e. 12.4% (including PLN 24 million relating to the mandatory payment designated for payment of amounts guaranteed to deponents in connection with the bankruptcy of Bank Spółdzielczy in Nadarzyn carried out in 2016);

- a decrease in sundry costs of PLN 10 million, i.e. 0.8%.

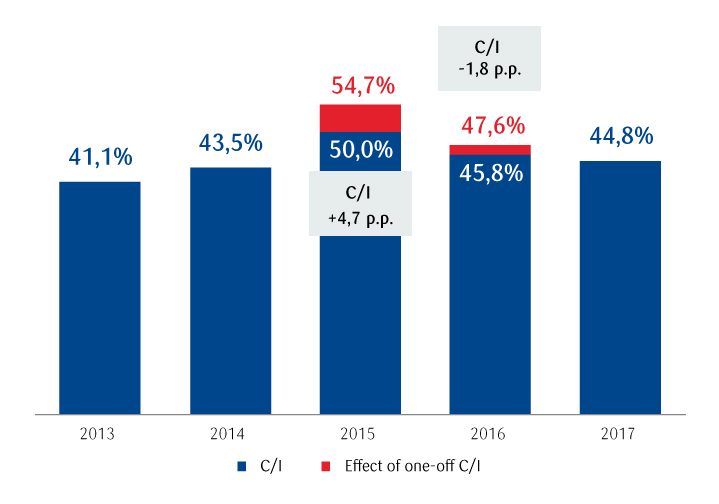

The operating effectiveness of PKO Bank Polski SA measured with the C/I ratio in annual terms amounted to 44.8% and improved by 1.0 p.p. y/y thanks to an improved result on business activity (+2.4% y/y), accompanied by an increase in administrative expenses (+0.1% y/y).

In 2017, the Bank incurred entertainment costs, expenditure on legal services, marketing services, public relations and social communication services and advisory services related to management in the total amount of PLN 138 million, which represented 2.7% of the Bank’s total administrative expenses.

Administrative expenses (in PLN million)

C/I ratio of PKO Bank Polski SA

Bank tax

From February 2016, banks and other financial institutions are obliged to pay tax on some financial institutions. The charge for PKO Bank Polski SA in respect of this tax in 2017 amounted to PLN 894 million and it went up by PLN 74 million, i.e. 9.0% compared with 2016.

Net impairment allowance and write-downs

The amount of the net impairment allowance and write-downs is a result of PKO Bank Polski SA continuing its conservative policy applied in the valuation of credit risk and an increase in the loan portfolio.

Net impairment allowance and write-downs in 2017 amounted to PLN -1,530 million and was PLN 121.7 million worse that that obtained in 2016. The deterioration in 2017 occurred as a result of an increase in allowances for depreciation of securities and assets and the deterioration of the result on the portfolio of consumer loans.

The share of impaired loans and coverage of loans with recognized impairment as at the end of 2017 amounted to 5.6% (up by 0.2 p.p. compared with 2016) and 65.9% (up by 2.0 p.p. compared with 2016), respectively.

The cost of risk1 as at the end of 2017 amounted to 0.71% and it was improved by 0.05 p.p. in 2016 thanks to an improved result on business and housing loans.

1 Calculated by dividing net impairment allowances on loans and advances to customers for the 12 months ended 31 December 2017 and 2016 by the average balance of gross loans and advances to customers at the start and end of the reporting period and interim quarterly periods.

Net impairment allowance on loans of PKO Bank Polski SA (in PLN million)