The situation of the Polish banking sector

The banking sector is the largest proportion of the financial system in Poland – the banking sector’s assets (PLN 1,800bn at the end of 2017 ) constitute more than two-thirds of the financial system assets.

616 banks were operating in Poland at the end of 2017, of which 35 were commercial, 553 cooperative and 28 were branches of lending institutions. A stable, low level of concentration of the banking sector was maintained, measured by the share of the five largest banks in total assets at 47.8%. In the last three years, acquisitions mainly applied to medium-sized banks, from outside the group of the five largest banks. 47.8% share of the 5 largest banks in the assets of the banking sector at the end of 2017

A material change took place in the ownership structure of the banking sector in 2017. Following the acquisition by PZU SA and PFR SA of control over Pekao SA, the share of domestic investors in the assets of the banking sector was higher than the share of foreign investors for the first time since 1999. At the end of 3Q, 2017 it was 54.5% (43.4% at the end of 2016).

The ratio of banking sector assets to GDP in Poland remained stable and amounted to 90.4% at the end of 3Q, 2017.

It was still less than a third of that in the euro area (278.9%). The level of the bank penetration ratio in Poland was below the average for the euro area – the share of the population aged over 15 years having a bank account with a financial institution was in Poland approximately 78% compared to approximately 95% in the euro area.

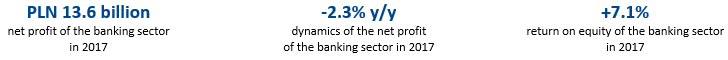

In 2017, PKO Bank Polski SA and its subsidiaries operating in Poland functioned in conditions of a favourable macroeconomic situation. The continuing economic recovery created favourable conditions for the stable development of business. The good business climate arose mainly from rapidly growing private consumption, export growth and an increasingly stronger recovery of investments. An important factor affecting banking in Poland was the environment of low interest rates, which had a negative impact on the level of interest margin achieved, with a positive impact on the quality of the loans portfolio. The return on equity in the banking sector (ROE) in 2017 declined to 7.1% (7.8% in 2016) remaining under the influence of high regulatory charges.

Net profit and profitability of the banking sector1

In 2017, the financial and business results of the banking sector were supported, among other things, by the high growth dynamics of the economy, favourable financial situation of households and good mood among enterprises. Banks continued to function in an environment of low interest rates.

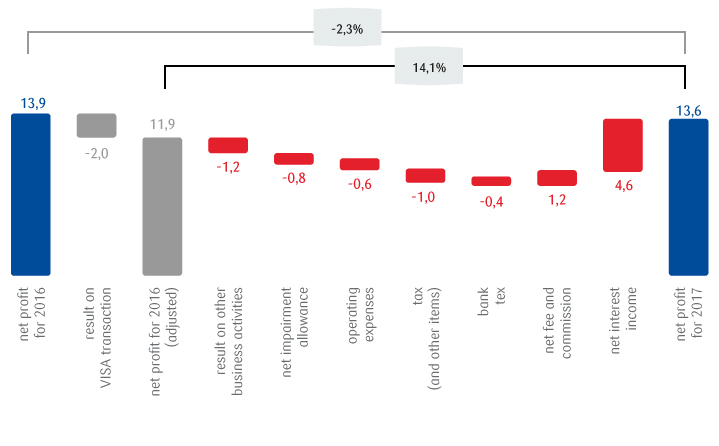

The banking sector generated a net profit of PLN 13.6 billion compared with PLN 13.9 billion in 2016 (-2.3% y/y)2 . The effect of the high reference base related to income from Visa transactions3 had a significant effect on the annual dynamics of the net profit. Without its effect, the net profit would increase by approx. +14% y/y. A strong increase in net interest income (PLN +4.6 billion y/y; +12.1%) and net commission income (PLN +1.2 billion; +9.1%) had a positive effect on the level of net profit generated. Despite the good macroeconomic situation in 2017, net impairment allowances of loans and borrowings were significantly deteriorated (+9.4% y/y). Banks continued actions aimed at increasing effectiveness, among other things, through optimization of the sales network, which had a positive effect on the level of costs. Despite the burdens related to digitization and cyber security, the growth dynamics of the banking sector’s operating expenses amounted to 1.8% y/y (excluding bank tax).

Change in the net profit of the banking sector (PLN billion)

Source: the PFSA, calculations of PKO Bank Polski SA; operating expenses including bank tax

In 2017, the return on equity of the banking sector deteriorated (ROE4; 7.1% compared with 7.8% in 2016) and remained under the influence of high regulatory and supervisory burdens. The decrease in ROE of the banking sector is also related to the effect of the high reference base – after excluding the effect of Visa transactions, ROE in 2016 would amount to approx. 6.6%.

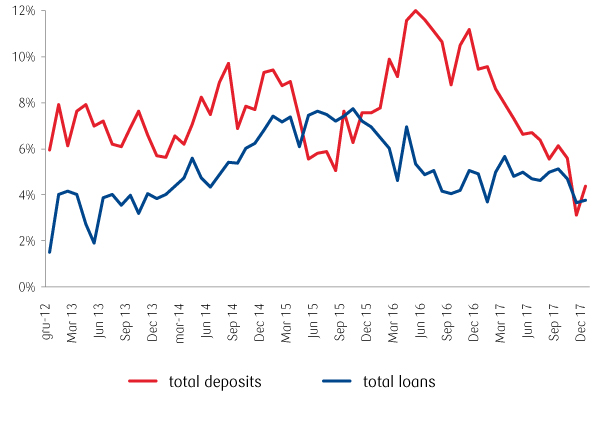

Loan and deposit market5

In 2017, there was a revival in lending activity but due to the strengthening of the Polish zloty it was not noticeable in the annual growth dynamics of total loans which slowed down as at the end of 2017 to 3.7% (4.9% as at the end of 2016).

Change dynamics of total loans and total deposits (y/y)

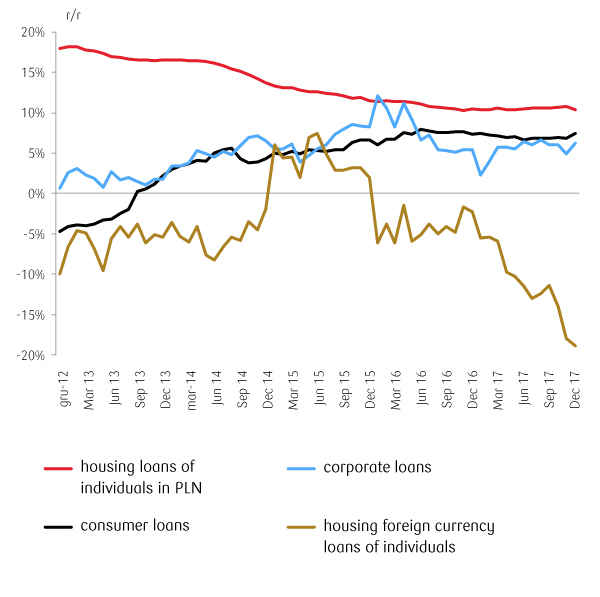

The growth dynamics for the corporate sector increased and amounted to 6.2% y/y compared with 5.4% at the end of 2016 (net of the exchange rate effect).

The strengthening of the zloty had a particularly important effect on the dynamics of aggregate housing loans, the volume of which went down y/y (-1.5%), despite the fact that the growth dynamics of PLN housing loans in 2017 remained at a stable level (10.4% as at the end of 2017 compared with 10.5% as at the end of 2016).

Change dynamics of loans (y/y)

The annual growth dynamics of consumer loans slowed down slightly in the first half of 2017, however, at the end of 2017, their volume went up at a similar pace to that achieved at the end of 2016 (7.4% compared with 7.3% respectively).

The low attractiveness of bank deposits resulting from, among other things, a record low level of basic interest rates and regulatory burdens for the banking sector, resulted in a gradual slowdown of the growth dynamics of aggregate deposits in 2017 (to 4.4% y/y compared with 9.5% y/y at the end of 2016).

Change dynamics of deposits and IF assets of individuals (y/y)

Households were looking for more profitable forms of investing cash. This resulted in a decrease in term deposits of individuals in 2017 (-6.6% y/y compared with +0.9% y/y as at the end of 2016) and a gradual slowdown in the growth dynamics of their current deposits to 12.6% y/y (18.5% y/y as at the end of 2016).

At the same time, there was an increased net inflow of funds to the investment fund market and a high share of real estate purchases for cash. In 2017, the annual growth dynamics of corporate deposits slowed down significantly (3.4% compared with 8.2% as at the end of 2016).

In 2017, the liquidity of the banking sector remained good. The loan to deposit ratio was below 100% (98.1% as at the end of 2017; -0.6 p.p. y/y). Despite the slowing growth dynamics of deposits, the lower ratio of loans to deposits y/y was possible thanks to the strengthening of the Polish zloty.

The banking sector is the largest proportion of the financial system in Poland – the banking sector’s assets (PLN 1,800bn at the end of 20172) constitute more than two-thirds of the financial system assets.

616 banks were operating in Poland at the end of 2017, of which 35 were commercial, 553 cooperative and 28 were branches of lending institutions2. A stable, low level of concentration of the banking sector was maintained, measured by the share of the five largest banks in total assets at 47.8%. In the last three years, acquisitions mainly applied to medium-sized banks, from outside the group of the five largest banks.

47.8%

share of the 5 largest banks in the assets of the banking sector at the end of 2017

A material change took place in the ownership structure of the banking sector in 2017. Following the acquisition by PZU SA and PFR SA of control over Pekao SA, the share of domestic investors in the assets of the banking sector was higher than the share of foreign investors for the first time since 1999. At the end of 3Q, 2017 it was 54.5% (43.4% at the end of 2016).

54.5%

share of domestic investors in assets of the banking sector at the end of 3Q, 2017.

The ratio of banking sector assets to GDP in Poland remained stable and amounted to 90.4% at the end of 3Q, 2017.

It was still less than a third of that in the euro area (278.9%). The level of the bank penetration ratio in Poland was below the average for the euro area – the share of the population aged over 15 years having a bank account with a financial institution was in Poland approximately 78% compared to approximately 95% in the euro area.

In 2017, PKO Bank Polski SA and its subsidiaries operating in Poland functioned in conditions of a favourable macroeconomic situation. The continuing economic recovery created favourable conditions for the stable development of business. The good business climate arose mainly from rapidly growing private consumption, export growth and an increasingly stronger recovery of investments. An important factor affecting banking in Poland was the environment of low interest rates, which had a negative impact on the level of interest margin achieved, with a positive impact on the quality of the loans portfolio. The return on equity in the banking sector (ROE) in 2017 declined to 7.1% (7.8% in 2016) remaining under the influence of high regulatory charges.

1 Based on the data from the PFSA; calculations of PKO Bank Polski SA.

2 Data on the banking sector published by the PFSA for 2016 and 2017 is difficult to compare due to one-off events in the banking sector and the changes in presentation introduced by one of the commercial banks. The level of net profit is comparable but the individual income statement items are difficult to compare.

3 The Visa transaction: acquisition of Visa Europe Ltd. by Visa Inc.; in June 2016, banks generated income from the sale of shares of Visa Ltd. of approx. PLN 2.5 billion (effect on the net profit of approx. PLN 2.0 billion).

4 Return on equity (ROE) – the ratio of the net profit of the banking sector for 2017 to average equity in 2017.

5 Based on: NBP data, Analizy Online service; calculations of PKO Bank Polski SA