Description of the PKO Bank Polski SA Group activities

The Powszechna Kasa Oszczędności Banku Polskiego SA Group (the PKO Bank Polski SA Group, the Bank’s Group) is one of the largest financial institutions in Poland and one of the largest financial groups in Central and Eastern Europe. Powszechna Kasa Oszczędności Bank Polski Spółka Akcyjna (PKO Bank Polski SA or the Bank), the parent company of the Bank’s Group, is the largest commercial bank in Poland and a leading bank on the Polish market in terms of scale of operations, equity, loans, deposits, number of customers and size of the distribution network. The Bank’s Group stands out on the Polish market due to its high results of operations which ensure its stable and safe development.

PKO Bank Polski SA is a universal bank which provides services to individuals, legal persons and other entities which are Polish and foreign persons.

Apart from strictly banking and brokerage activities, the PKO Bank Polski SA Group offers a range of specialist services relating to leasing, factoring, investment funds, pension funds and insurance; transfer agent, outsourcing of IT professionals and support services; it also conducts banking activities and provides financial services outside Poland through its branches in Germany, the Czech Republic and its subsidiaries in Ukraine.

Throughout the whole period of its activity, the Bank’s Group has been consistently developing the prestige of its brand and providing services to many generations of Poles. The long tradition and customer confidence are important elements of the PKO Bank Polski SA Group’s identity, therefore, consistent measures are taken to reinforce its perception as a group of institutions which are:

- safe, strong and competitive;

- modern and innovative, customer friendly and efficiently managed;

- socially responsible, concerned about the development of Poles’ cultural awareness.

Despite keen market competition, the PKO Bank Polski SA Group effectively develops its operations, not only in the traditional area of its operations, which is retail banking. It has also become a leader in serving corporate customers and small- and medium-sized enterprises (especially with regard to the financing of their operations) and for the market of financial services offered to municipalities, poviats, voivodeships and the public sector. It is also the foremost underwriter of municipal bonds.

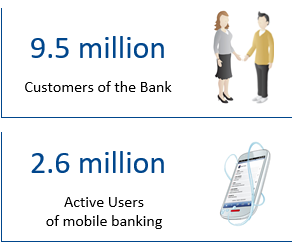

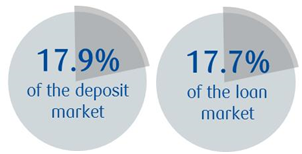

he PKO Bank Polski SA Group has leading market shares in the Polish banking market for deposits (17.9%) and loans (17.7%), in the lease market (12.0%) and the market of non-dedicated investment funds (17.2%). PKO Bank Polski SA is a leader in terms of the number of current accounts and payment cards maintained.

High customer service standards and effective procedures for assessing credit risk enabled the Bank’s Group in to increase its net loan portfolio to PLN 206 billion in 2017. Amounts due to customers as at the end of 2017 totalled PLN 219 billion.

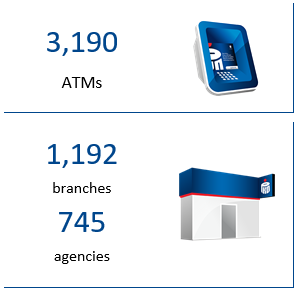

In 2017, the Bank’s Group continued its activities aimed at increasing the effectiveness of the distribution network. As at the end of 2017, the largest network of PKO Bank Polski SA branches in Poland comprised 1,192 branches and 745 agencies. The Bank’s customers can use systematically enhanced electronic banking services offered under the iPKO brand and as part of the Inteligo account, and IKO mobile payments. Customers of PKO Bank Polski SA have a developed network of ATMs at their disposal, which as at the end of 2017 comprised 3,190 ATMs.

The PKO Bank Polski SA Group is one of the largest employers in Poland. As at the end of 2017, the PKO Bank Polski SA Group employed more than 28 thousand full-time employees. The comprehensive training and education offer serves the purpose of building a professional and loyal team of employees able to provide high quality customer services and achieve outstanding results.

The Bank’s social responsibility is reflected in the operations of PKO Bank Polski SA’s Foundation which are performed for the benefit of the public.

The PKO Bank Polski SA Group in the years 2013–2017

| 2017 | 2016 | 2015 | 2014 | 2013 | |

|---|---|---|---|---|---|

| Statement of financial position (in PLN million) | |||||

| Total assets | 296 912 | 285 573 | 266 940 | 248 701 | 199 231 |

| Equity | 36 256 | 32 569 | 30 265 | 27 616 | 25 154 |

| Loans and advances to customers | 205 628 | 200 606 | 190 414 | 179 497 | 149 623 |

| Amounts due to customers | 218 800 | 205 066 | 195 759 | 174 387 | 151 904 |

| Income statement (in PLN million) | |||||

| Net profit for the year | 3 104 | 2 874 | 2 610 | 3 254 | 3 230 |

| Net interest income | 8 606 | 7 755 | 7 029 | 7 523 | 6 722 |

| Net fee and commission income | 2 969 | 2 693 | 2 851 | 2 934 | 3 006 |

| Net other income | 988 | 1 342 | 786 | 690 | 979 |

| Result on business activities | 12 563 | 11 790 | 10 665 | 11 147 | 10 707 |

| Net impairment allowance and write-downs | -1 620 | -1 623 | -1 476 | -1 899 | -2 038 |

| General administrative expenses | -5 784 | -5 590 | -6 036 | -5 245 | -4 623 |

| Financial ratios | |||||

| Net ROA | 1,1% | 1,1% | 1,0% | 1,4% | 1,6% |

| Net ROE | 9,0% | 9,1% | 9,0% | 12,4% | 13,2% |

| C/I | 46,0% | 47,4% | 56,6% | 47,1% | 43,2% |

| Interest margin | 3,3% | 3,2% | 3,0% | 3,6% | 3,7% |

| Share of impaired loans | 5,5% | 5,9% | 6,6% | 6,9% | 8,2% |

| Cost of risk | -0,71% | -0,75% | -0,72% | -0,96% | -1,31% |

| Total capital ratio | 17,37% | 15,81% | 14,61% | 12,96% | 13,58% |

| Number of customers of PKO Bank Polski SA (in thousands) | 9 498 | 9 199 | 8 982 | 8 894 | 8 451 |

| Retail customers (in thousands) | 9 044 | 8 756 | 8 538 | 8 431 | 8 024 |

| SME (in thousands) | 439 | 429 | 430 | 449 | 415 |

| Corporate customers (in thousands) | 15 | 15 | 14 | 14 | 12 |

| Operational data | |||||

| Number of branches of PKO Bank Polski SA | 1 192 | 1 238 | 1 278 | 1 319 | 1 186 |

| Number of employees (FTE) | 28 443 | 29 163 | 28 944 | 28 749 | 27 093 |

| Number of current accounts in the Bank (in thousands) | 7 134 | 6 850 | 6 621 | 6 660 | 6 318 |

| Information on shares | |||||

| Stock exchange capitalization (in PLN million) | 55 388 | 35 175 | 34 163 | 44 700 | 49 275 |

| Number of shares (in millions) | 1 250 | 1 250 | 1 250 | 1 250 | 1 250 |

| Share price (in PLN) | 44,31 | 28,14 | 27,33 | 35,76 | 39,42 |

| Dividend per share (in PLN) (paid in a given year for the previous year) | 0,00 | 0,00 | 0,00 | 0,75 | 1,80 |