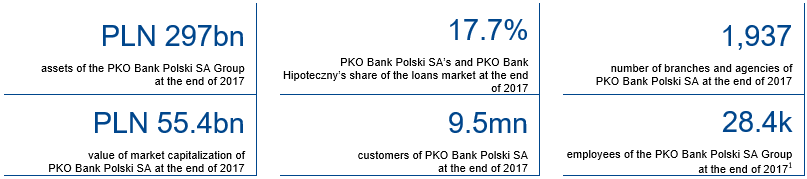

The PKO Bank Polski SA Group is a leading financial institution in Central and Eastern Europe. PKO Bank Polski SA, the parent entity in the Group, is the largest commercial bank in Poland in terms of asset value and equity, the value of loans and deposits, the size of the distribution network, market capitalization, as well as the number of customers served and the number of employees.

A strong increase in the net profit of the PKO Bank Polski SA Group against the banking groups belonging to its peer group

Net profit

Despite the high one-off income generated in 2016 (the VISA transaction) and an increase in regulatory charges in 2017, the PKO Bank Polski SA Group recorded a noticeable increase in the net profit y/y compared with a significantly smaller increase in the net profits in the peer group (in spite of significant one-off profits recorded in the peer group in 2017).

A small increase in the return on assets of the PKO Bank Polski SA Group compared with a small decrease in the peer group

As at the end of 2017, the return on assets of the PKO Bank Polski SA Group increased slightly y/y compared with a slight decrease in the peer group. In the conditions of high regulatory and supervisory burdens affecting the level of capital maintained by banks, as at the end of 2017, the PKO Bank Polski SA Group recorded a slight decrease in the return on equity (ROE), compared with the stabilization in the peer group in which one-off profits were generated.

Return on assets

Return on equity

Improvement in cost efficiency of the PKO Bank Polski SA Group and of the peer group, mainly due to improved results on business activities

Cost effectiveness

- an improvement in the result on business activities (mainly net interest income) compared with 2016;

- cost discipline maintained by banks, despite the growing spending on digitization and cyber security.

Total capital ratio

*The peer group includes the following Groups: Pekao SA, BZ WBK SA, mBank SA, ING Bank Śląski SA. The data required for calculating the ratios come from consolidated annual and quarterly reports and preliminary information on the results for 2017 of the individual banks.