Market position of the Bank’s Group

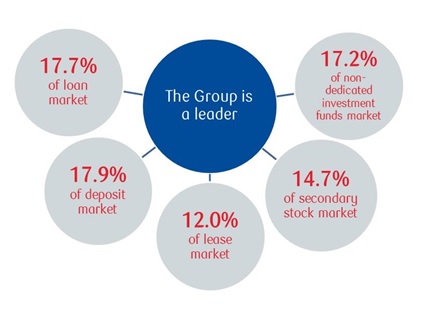

The PKO Bank Polski SA Group has leading market shares in the Polish banking market of loans and deposits, in the Polish lease market and the Polish retail investment funds market.

The companies in the Bank’s Group occupy leading positions in individual sectors of the financial services market.

It is worth emphasizing that Dom Maklerski PKO Banku Polskiego SA has a high share in the transaction volume on the secondary market, amounting to 14.7%, which placed Dom Maklerski in first position in the ranking of brokerage houses.

Market share

| 31.12.2017 | 31.12.2016 | 31.12.2015 | 31.12.2014 | 31.12.2013 | Change 2017/2016 | |

| Loans to:* | 17.7% | 17.8% | 17.9% | 17.9% | 16.1% | -0.1 p.p. |

| individuals. including: | 23.0% | 22.8% | 22.9% | 22.9% | 19.1% | 0.2 p.p. |

| housing | 26.1% | 25.7% | 25.5% | 25.8% | 20.6% | 0.4 p.p. |

| PLN | 28.6% | 28.6% | 28.7% | 29.6% | 28.4% | 0 p.p. |

| currency | 21.2% | 21.4% | 21.5% | 21.5% | 12.8% | -0.2 p.p. |

| consumer and other | 15.9% | 15.8% | 16.1% | 15.6% | 15.4% | 0.1 p.p. |

| institutions | 12.8% | 12.9% | 13.0% | 13.1% | 13.1% | -0.1 p.p. |

| Deposits: | 17.9% | 17.3% | 17.9% | 17.3% | 16.3% | 0.6 p.p. |

| individuals | 20.4% | 20.7% | 20.7% | 21.7% | 21.7% | -0.3 p.p. |

| institutions | 14.5% | 12.4% | 14.0% | 11.5% | 9.4% | 2.1 p.p. |

| Leases** | 12.0% | 7.5% | 6.1% | 6.4% | 7.2% | 4.5 p.p. |

| Investment fund company assets | ||||||

| non-dedicated funds | 17.2% | 14.4% | 14.3% | 13.9% | 13.4% | 2.8 p.p. |

| Other than treasury debt securities (amount of debt) | 29.3% | 29.2% | 28.8% | 31.5% | 20.1% | 0.1 p.p. |

| Brokerage activities | ||||||

| secondary market transactions | 14.7% | 9.4% | 9.1% | 10.5% | 9.5% | 5.3 p.p. |

Source: NBP, GPW, Polish Lease Assocition

*Data according to the reporting system for NBP - Webis. In the quarter of 2016, the market share were update as a result of changing the presentation of the market data for the period from September 2014 to September 2016. Receivables from mortage banks, which so far were presented in other receivables classified as consumer loans, is now recorded in housing loans to households.

**Share as at 31 December 2016 takes into account 1 month's sales of Raiffeisen - Leasing Polska SA.