Definition

Credit risk is defined as the risk of occurrence of losses due to customer’s default of payments do the Group or as a risk of decrease in the economic value of amounts due to the Group as a result of deterioration of customer’s ability to repay amounts due to the Group.

Risk management objective

The objective of credit risk management is to minimize losses on the loan portfolio as well as minimize the risk of the occurrence of loans exposed to impairment, while maintaining the expected level of profitability and value of the loan portfolio.

The Bank and the Group subsidiaries are guided mainly by the following credit risk management principles:

- each loan transaction is subject to comprehensive credit risk assessment, which is reflected in an internal rating or credit scoring,

- credit risk relating to loan transactions is measured at the stage of examining a loan application and on a regular basis, as part of the monitoring process, taking into consideration changes in the external conditions and in the financial standing of the borrowers,

- credit risk assessment of exposures is separated from the sales function by ensuring an appropriate organizational structure, independence in developing and validating tools supporting the assessment of credit risk and the independence of the decisions approving deviations from the suggestions resulting from the use of these tools,

- the terms and conditions of a loan transactions offered to a customer depend on the assessment of the credit risk level generated by the transaction,

- credit decisions may be taken solely by authorized persons,

- credit risk is diversified, in particular, in terms of geographical area, industry, products and customers;

- an expected credit risk level is mitigated by collateral received by the Bank, margins from customers and impairment allowances (provisions) on loan exposures.

The above-mentioned principles are executed by the Group through the use of advanced credit risk management methods, both at the level of individual credit exposures and the entire loan portfolio of the Group. These methods are verified and developed to ensure compliance with the requirements of the internal rating-based method (IRB), i.e. an advanced credit risk measurement method which may be used to calculate the capital requirements for credit risk, subject to approval by the Polish Financial Supervision Authority.

The Group entities which have significant credit risk levels (the KREDOBANK SA Group, the PKO Leasing SA Group, PKO Bank Hipoteczny SA and Finansowa Kompania “Prywatne Inwestycje”’ Sp. z o.o.) manage their credit risk individually, but the methods used for credit risk assessment and measurement are adjusted to the methods used by PKO Bank Polski SA, taking into account the specific nature of the activities of these companies.

Any changes to the solutions used by the Group’s subsidiaries are agreed every time with the Bank’s units responsible for risk management.

The PKO Leasing SA Group, the KREDOBANK SA Group as well as Finansowa Kompania “Prywatne Inwestycje” Sp. z o.o. and PKO Bank Hipoteczny SA measure their credit risk regularly and the results of such measurements are submitted to the Bank.

Within the structures of PKO Bank Hipoteczny SA, the KREDOBANK SA Group and the PKO Leasing SA Group, there are organizational units in the risk management areas which are responsible, in particular, for:

- developing methodologies for credit risk assessment, recognition of provisions and allowances,

- controlling and monitoring credit risk during the lending process,

- the quality and efficiency of restructuring and enforcement of the amounts due from clients.

In these companies, the credit decision limits depend primarily on: the amount of the exposure to a given customer; the amount of an individual credit transaction and the period of credit transaction.

The process of credit decision-making in PKO Bank Hipoteczny SA, the KREDOBANK SA Group, the PKO Leasing SA Group is supported by credit committees which are involved in the process for credit transactions which generate an increased credit risk level.

Relevant organizational units of the Risk Management Area participate in managing the credit risk in the Group entities by consulting projects and periodically reviewing the internal regulations of these entities relating to the assessment of credit risk and by making recommendations for amendments to such internal regulations. The Bank supports the implementation of the recommended changes in credit risk assessment policies in the Group entities.

Credit risk management

Measurement and assessment of credit risk

- Credit risk measurement and assessment methods

In order to assess the level of credit risk and the profitability of loan portfolios, the Group uses different credit risk measurement and valuation methods, including:

- probability of default (PD),

- expected loss (EL),

- unexpected loss (UL),

- loss given default (LGD),

- credit value at risk (CVaR),

- share and structure of impaired loans,

- coverage ratio of impaired loans with impairment allowances,

- cost of credit risk.

The Group systematically expands the scope of credit risk measures used, taking into account the requirements of the IRB method, and extends the use of risk measures to cover the entire loan portfolio of the Group with these methods.

The portfolio credit risk measurement methods allow, among other things, to reflect the credit risk in the price of products, determine the optimum conditions of financing availability and determine the rates of impairment allowances.

The Group performs analyses and stress-tests relating to the impact of the potential changes in the macroeconomic environment on the quality of the Group’s loan portfolio, and the results are presented in reports to the Bank’s authorities. The above-mentioned information enables the identification and implementation of the measures mitigating the negative effects of the impact of unfavourable market conditions on the Group’s outcome.

- Rating and scoring methods

An assessment of the risk of individual loan transactions is performed by the Group using the scoring and rating methods which are supported by specialist IT applications. The risk assessment method is defined in the Group’s internal regulations whose main aim is to ensure a uniform and objective evaluation of the credit risk during the lending process.

The Group evaluates the credit risk of retail customers in two dimensions: creditworthiness assessed qualitatively and quantitatively. A quantitative creditworthiness assessment consists of examining a customer’s financial situation, whereas the qualitative assessment involves scoring and evaluating a customer’s credit history obtained from the Group’s internal records and external databases.

In the case of corporate customers in the small and medium enterprises segment who meet certain criteria, the Group assesses credit risk using the scoring method. Such assessment refers to low-value, non-complex loan transactions and it is performed in two dimensions: a customer’s borrowing capacity and his creditworthiness. An assessment of the borrowing capacity involving examining a customer’s economic and financial position, whereas the assessment of creditworthiness involves scoring and evaluating the customer’s credit history obtained from the Group’s internal records and external databases.

In other cases, the rating method is used for institutional customers.

The evaluation of credit risk associated with financing institutional customers is performed by the Bank in two dimensions: the customer and the transaction. The measures involved include an evaluation of the customer's creditworthiness, i.e. the rating, and an assessment of the transaction risk, i.e. the customer's ability to repay the liabilities due in the amounts and on the dates specified.

Rating models for institutional customers are developed using the Group’s internal data, thus ensuring that they are tailored to the risk profiles of the Group’s customers. Models are based on a statistical dependence analysis between the default and the customer's risk scoring. The scoring includes an evaluation of financial ratios, qualitative factors and behavioural factors. A customer's risk assessment depends on the size of the enterprise assessed. In addition, the Group applies a model for the assessment of credited entrepreneurs in the formula of specialized lending, which allows an adequate credit risk assessment of large projects involving real estate financing (e.g. office space, retail space, industrial space) and infrastructure projects (e.g. telecommunication, industrial, public utility infrastructure).

The rating models are implemented in the IT tool which supports the assessment of the Group’s credit risk associated with the financing of institutional customers.

In order to examine the correctness of functioning of the methods applied by the Group, credit risk assessment methodologies relating to individual loan exposures are subject to periodical reviews.

The credit risk assessment process in the Group takes into account the requirements of the Polish Financial Supervision Authority as defined in Recommendation S concerning good practices for the management of mortgage-secured loan exposures and Recommendation T concerning good practices for the management of retail credit exposures.

The information on rating and scoring assessments is widely used in the Group to manage credit risk, in the system of credit decision making powers, determining the conditions in which credit risk assessment services are activated and in the credit risk measurement and reporting system.

Credit risk monitoring

Credit risk is monitored at the level of individual loan transactions and at portfolio level.

Credit risk monitoring at the individual loan transaction level is governed, in particular, by the Group’s internal regulations concerning:

- the principles for the recognition of impairment allowances for loan exposures and impairment allowances on receivables in respect of unsettled forward transactions,

- the rules of functioning the Early Warning System at the Bank,

- early monitoring of delays in the collection of receivables,

- the principles for the classification of loan exposures and determining the level of specific provisions.

In order to shorten the time of reaction to the warning signals noted, signaling an increased credit risk level, the Group uses and develops an IT application, Early Warning System (EWS).

Credit risk monitoring at the portfolio level consists of:

- supervising the level of the portfolio credit risk based on the tools used for measuring credit risk, taking into consideration the identified sources of credit risk and analysing the effects and actions taken as part of system management,

- recommending preventive measures in the event of identifying an increased level of credit risk.

Credit risk reporting

The Group prepares monthly and quarterly credit risk reports. The reporting of credit risk covers cyclic information on the scale of the risk exposure of the loan portfolio. In addition to information for the Bank, the reports also include information on the level of credit risk in the Group entities where a material level of credit risk was identified (e.g. the KREDOBANK SA Group, the PKO Leasing SA Group, PKO Bank Hipoteczny SA).

Management actions relating to credit risk

The basic credit risk management tools used by the Group include:

- minimum transaction requirements (risk parameters) determined for a given type of transaction (e.g. minimum LTV value, maximum loan amount, required collateral),

- the principles of defining credit availability, including cut-offs – the minimum number of points awarded in the process of creditworthiness assessment with the use of a scoring system (for retail customers and SMEs) or the customer’s rating class (for corporate clients), which a client must obtain to receive a loan,

- concentration limits – limits defined in the Regulation of the European Parliament and the Council (EU) No. 575/2013 on prudential requirements for credit institutions and investment firms (CRR Regulation) and the Polish Banking Law, or internal limits defining the concentration risk appetite,

- industry-related limits – limits which reduce the risk level related to financing institutional customers conducting business activities in industries characterized by a high level of credit risk,

- limits on credit exposures related to the Group's customers – the limits defining the appetite for credit risk resulting from, among other things, Recommendations S and T,

- credit limits defining the Group’s maximum exposure to a given customer or a country in respect of wholesale market transactions, settlement limits and limits for the period of exposure,

- competence limits – the limits defining the maximum level of credit decision-making powers with regard to the Group's customers; the limits depend primarily on the amount of the Bank’s exposure to a given customer (or group of related customers) and the lending period; the competence limits depend on the level (in the Bank’s organizational structure) at which credit decisions are made,

- minimum credit margins – credit risk margins relating to a given credit transaction concluded by the Group with a given corporate customer, but the interest rate offered to the customer cannot be lower than the reference rate plus credit risk margin.

Use of credit risk mitigation techniques – Collateral

The collateral management policy plays a significant role in establishing credit transaction terms. The Group's collateral management policy is intended to properly protect it against credit risk to which the Bank and the Group are exposed, including above all the fact of establishing collateral that is as liquid as possible. Collateral may be considered liquid if it is possible to be sold without a significant decrease in its price and at a time which does not expose the Bank to a change in the collateral value due to price fluctuations typical for a given collateral.

The Group strives to diversify collateral in terms of forms and assets used as collateral.

The Group evaluates collateral from the perspective of the actual possibility of using it to satisfy its claims.

In addition, when assessing collateral, the Group takes into account the following factors:

- the economic, financial and economic or social and financial position of entities which provide personal guarantees,

- the condition and market value of the assets accepted as collateral and their vulnerability to depreciation in the period of maintaining the collateral (the impact of the technological wear and tear of a collateralized asset on its value),

- potential economic benefits of the Group resulting from a specific method of securing receivables, including, in particular, the possibility of reducing impairment allowances,

- the method of establishing collateral, including the typical duration and complexity of formalities, as well as the necessary costs (the costs of maintaining collateral and enforcement against the collateral), using the Group’s internal regulations concerning the assessment of collateral,

- the complexity, time-consuming nature and economic and legal conditions for the effective realization of collateral, in the context of enforcement restrictions and the applicable principles for the distribution of the sums obtained from individual enforcement or in the course of bankruptcy proceedings, the ranking of claims,

- establishing the certain types of collateral depends on the level of risk of a given customer or transaction.

When granting loans intended to finance housing and commercial properties, a mortgage is an obligatory type of collateral.

Until an effective protection is established (depending on the type and amount of a loan), the Group can accept temporary collateral in different form.

With regard to consumer loans, usually personal guarantees are used (a civil law surety/guarantee, a bill of exchange) or collateral is established on the customer’s bank account, car or securities.

The collateral for loans intended for the financing of small and medium-sized enterprises as well as corporate customers is established, among other things: on receivables from business operations, bank accounts, movables, real estate or securities or in the form of BGK guarantees (universally used in respect of small and medium enterprises). The collateral management policy is set out in the internal regulations of the Group's subsidiaries.

When concluding leasing agreements, the PKO Leasing SA Group, as the owner of the leased assets, treats them as collateral.

| 31.12.2017 | 31.12.2016 | |||||

|---|---|---|---|---|---|---|

| Gross amount | Allowances | Net amount | Gross amount | Allowances | Net amount | |

| Loans and advances to customers | ||||||

| individual method, including: | 5420 | -2103 | 3317 | 6551 | -2608 | 3943 |

| impaired | 4346 | -2097 | 2249 | 5049 | -2594 | 2455 |

| not impaired | 1074 | -6 | 1068 | 1502 | -14 | 1488 |

| portfolio method | 7354 | -5000 | 2354 | 7183 | -4766 | 2417 |

| impaired | 7332 | -5000 | 2332 | 7171 | -4766 | 2405 |

| not impaired | 22 | 0 | 22 | 12 | 0 | 12 |

| group method (IBNR) | 200678 | -720 | 199958 | 194875 | -629 | 194246 |

| Loans and advances granted, net | 213452 | -7823 | 205629 | 208609 | -8003 | 200606 |

In 2017 gross loans extended by the Bank’s Group measured using the individual method dropped by PLN 1,131 million, and using the portfolio method increased by PLN 171 million, whereas using the group method increased by PLN 5,803 million.

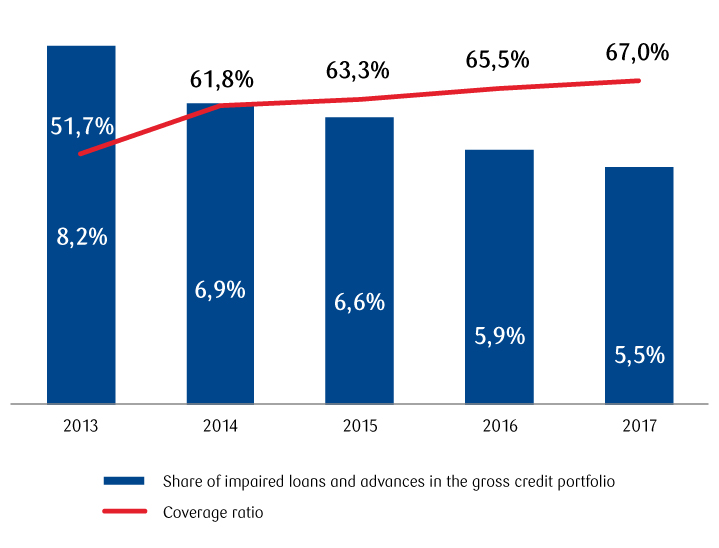

PKO Bank Polski SA Group’s share in impaired loans in the gross credit portfolio amounted to 5.5% as at 31 December 2017 and dropped by 0.4 p.p. compared with the share as at 31 December 2016.

The coverage ratio for the PKO Bank Polski SA Group amounted to 67.0% as at 31 December 2017 compared with 65.5% as at 31 December 2016.

Credit risk – financial information

Exposure to credit risk

| EXPOSURE TO CREDIT RISK – ITEMS OF THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION | 31.12.2017 | 31.12.2016 |

|---|---|---|

| Current account with the Central Bank | 13 137 | 9 140 |

| Amounts due from banks | 5 233 | 5 345 |

| Financial assets held for trading - debt securities | 405 | 312 |

| Derivative financial instruments | 2 598 | 2 901 |

| Financial instruments designated at fair value through profit or loss upon initial recognition - debt securities | 6 688 | 12 204 |

| Loans and advances to customers (excluding adjustments relating to fair value hedge accounting) | 205 629 | 200 606 |

| corporate | 56 792 | 52 915 |

| housing | 106 191 | 106 121 |

| consumer | 24 590 | 23 222 |

| debt securities (corporate) | 1 855 | 2 283 |

| debt securities (municipal) | 2 513 | 2 587 |

| receivables in respect of repurchase agreements | 902 | 1 339 |

| finance lease receivables | 12 786 | 12 139 |

| Available-for-sale investment securities- debt securities | 43 192 | 36 142 |

| Investment securities held to maturity | 1 812 | 466 |

| Other assets - other financial assets | 2 377 | 2 247 |

| Total | 281 071 | 269 363 |

| EXPOSURE TO CREDIT RISK - OFF-BALANCE SHEET ITEMS | 31.12.2017 | 31.12.2016 |

|---|---|---|

| Irrevocable liabilities granted | 33 607 | 31 078 |

| Guarantees issued | 6 065 | 6 630 |

| Underwriting of securities | 2 666 | 3 701 |

| Letters of credit issued | 1 409 | 1 600 |

| Total | 43 747 | 43 009 |

Past due financial assets

| FINANCIAL ASSETS PAST DUE BUT NOT IMPAIRED, GROSS | 31.12.2017 | |||

|---|---|---|---|---|

| up to 1 month | 1 - 3 months | over 3 months | Total | |

| Loans and advances to customers | 4 194 | 900 | 274 | 5 368 |

| Other assets - other financial assets | 1 | - | 9 | 10 |

| Total | 4 195 | 900 | 283 | 5 378 |

| FINANCIAL ASSETS PAST DUE BUT NOT IMPAIRED, GROSS | 31.12.2016 | |||

|---|---|---|---|---|

| up to 1 month | 1 - 3 months | over 3 months | Total | |

| Loans and advances to customers | 3 535 | 849 | 179 | 4 563 |

| Other assets - other financial assets | - | - | 11 | 11 |

| Total | 3 535 | 849 | 190 | 4 574 |

The receivables disclosed above are secured with the following types of collateral: mortgages, registered pledges, transfer of title, freezing of a deposit account, insurance of credit exposures and guarantees and sureties.

As part of an assessment performed, it has been concluded that the expected cash flows from the collateral fully cover the carrying amounts of these financial assets.

Financial assets assessed on an individual basis for which individual impairment has been recognized

| FINANCIAL ASSETS ASSESSED ON AN INDIVIDUAL BASIS FOR WHICH INDIVIDUAL IMPAIRMENT HAS BEEN RECOGNIZED, AT GROSS CARRYING AMOUNT | 31.12.2017 | 31.12.2016 |

|---|---|---|

| Loans and advances to customers | 4 346 | 5 049 |

| corporate loans | 3 640 | 3 963 |

| housing loans | 505 | 789 |

| consumer loans | 201 | 224 |

| debt securities | - | 73 |

| Available-for-sale investment securities | 822 | 1 297 |

| Total | 5 168 | 6 346 |

Loans and advances to customers were secured by the following collateral established for the PKO Bank Polski SA Group: mortgages, registered pledges, debtor’s promissory notes and transfers of receivables.

The financial effect of the collateral held in the amount which is the best reflection of the maximum exposure to credit risk as at 31 December 2017 amounted to PLN 2 251 million (PLN 2 801 million as at 31 December 2016).

Internal ratings

Taking into consideration the type of the Group’s business activity and the volume of credit and leasing debts, the most important portfolios are managed by the Bank and PKO Leasing SA.

Exposures to corporate customers which are not individually impaired are classified according to customer rating as part of the internal rating classes, from A to G (in respect of financial institutions from A to F).

The following portfolios are covered by the rating system:

- corporate market customers;

- small and medium-sized enterprises (excluding certain product groups assessed in a simplified manner).

Loans and advances which are not individually impaired and are not rated, are characterized with a satisfactory level of credit risk. This applies in particular to retail loans (including housing loans) which do not have individually significant exposures and thus do not create significant credit risk.

| FINANCIAL ASSETS NOT IMPAIRED, NOT PAST DUE | 31.12.2017 | 31.12.2016 |

|---|---|---|

| Loans and advances to customers | 196 406 | 191 827 |

| corporate loans | 50 584 | 47 030 |

| A (first rate) | 875 | 949 |

| B (very good) | 5 616 | 2 065 |

| C (good) | 9 575 | 6 665 |

| D (satisfactory) | 9 236 | 7 205 |

| E (average) | 11 205 | 12 232 |

| F (acceptable) | 10 541 | 14 245 |

| G (poor) | 3 536 | 3 669 |

| consumer and housing loans | 119 712 | 121 434 |

| A (first rate) | 105 780 | 99 924 |

| B (very good) | 8 976 | 8 939 |

| C (good) | 3 054 | 5 481 |

| D (average) | 1 216 | 4 653 |

| E (acceptable) | 686 | 2 437 |

| PKO Leasing SA Group | 4 851 | 8 776 |

| A (good) | 3 281 | 7 180 |

| B (average) | 1 365 | 768 |

| C (risky) | 205 | 828 |

| without an internal rationg - financial, non-financial and public sector customers (consumer loans, housing loans and other) | 21 259 | 14 587 |

| Debt securities available for sale | 5 147 | 5 088 |

| A (first rate) | 55 | 12 |

| B (very good) | 409 | 353 |

| C (good) | 1 061 | 712 |

| D (satisfactory) | 1 589 | 1 376 |

| E (average) | 1 131 | 1 462 |

| F (acceptable) | 795 | 1 070 |

| G (poor) | 74 | 63 |

| G3 (low) | 33 | 40 |

| Total | 201 553 | 196 915 |

External ratings

The structure of debt securities and amounts due from banks which are neither past due nor impaired by external rating classes is presented below:

| PORTFOLIO/RATING | AAA | AA- to AA+ | A- to A+ | BBB- to BBB+ | BB- to BB+ | B- to B+ | CCC- to CCC+ | Caa21 | 31.12.2017 |

|---|---|---|---|---|---|---|---|---|---|

| Amounts due from banks | 7 | 1 030 | 2 340 | 585 | 21 | 4 | 79 | - | 4 066 |

| Debt securities | 132 | - | 42 713 | 2 412 | 630 | 50 | - | 384 | 46 321 |

| NBP money market bills | - | - | 4 199 | - | - | - | - | - | 4 199 |

| Treasury bonds | - | - | 37 763 | - | - | - | - | 384 | 38 147 |

| municipal bonds | - | - | 183 | 68 | 42 | - | - | - | 293 |

| corporate bonds | 132 | - | 568 | 2 344 | 588 | 50 | - | - | 3 682 |

| TOTAL | 139 | 1 030 | 45 053 | 2 997 | 651 | 54 | 79 | 384 | 50 387 |

1 This applies to the securities of the KREDOBANK SA Group - according to the Moody's rating

| PORTFOLIO/RATING | AAA | AA- to AA+ | A- to A+ | BBB- to BBB+ | BB- to BB+ | B- to B+ | CCC- to CCC+ | Caa31 | 31.12.2016 |

|---|---|---|---|---|---|---|---|---|---|

| Amounts due from banks | 24 | 1 527 | 2 273 | 531 | 21 | 4 | 96 | - | 4 476 |

| Debt securities | 154 | 1 426 | 38 674 | 1 935 | 38 | 49 | - | 486 | 42 762 |

| NBP money market bills | - | - | 9 079 | - | - | - | - | - | 9 079 |

| Treasury bonds | - | - | 29 481 | - | - | - | - | 486 | 29 967 |

| municipal bonds | - | 15 | 114 | 104 | 38 | - | - | - | 271 |

| corporate bonds | 154 | 1 411 | - | 1 831 | - | 49 | - | - | 3 445 |

| TOTAL | 178 | 2 953 | 40 947 | 2 466 | 59 | 53 | 96 | 486 | 47 238 |

1 This applies to the securities of the KREDOBANK SA Group – according to the Moody’s rating

Concentration of credit risk at the Group

The Group defines credit concentration risk as the risk arising from a considerable exposure to single entities or groups of entities whose repayment capacity depends on a common risk factor. The Group analyses the risk of concentration towards:

- the largest entities;

- the largest groups;

- industry sectors;

- geographical regions;

- currencies;

- exposures secured with a mortgage.

The Polish Banking Law sets the limits of the maximum exposure of the Bank which are translated to the Group. The concentration risk of exposures to individual customers and groups of related customers is monitored in accordance with Regulation of the European Parliament and the Council (EU) No. 575/2013 on prudential requirements for credit institutions and investment firms (CRR), according to which the Group shall not assume an exposure to a customer or a group of related customers whose value exceeds 25% of the value of its recognized capital.

As at 31 December 2017 and 31 December 2016, concentration limits were not exceeded. As at 31 December 2017, the largest exposure to a single entity accounted for 8.6% of the recognized consolidated capital (10.4% as at 31 December 2016).

The Group’s exposure to the 20 largest non-banking customers:

| No. | CREDIT EXPOSURES INCLUDE LOANS, ADVANCES, PURCHASED DEBT, DISCOUNTED BILL OF EXCHANGE, REALIZED GUARANTEES, INTEREST RECEIVABLES AND OFF-BALANCE SHEET AND CAPITAL EXPOSURES1 | SHARE IN THE LOAN PORTFOLIO, INCLUDING OFF-BALANCE SHEET AND CAPITAL EXPOSURES | No. | CREDIT EXPOSURES INCLUDE LOANS, ADVANCES, PURCHASED DEBT, DISCOUNTED BILL OF EXCHANGE, REALIZED GUARANTEES, INTEREST RECEIVABLES AND OFF-BALANCE SHEET AND CAPITAL EXPOSURES1 | SHARE IN THE LOAN PORTFOLIO, INCLUDING OFF-BALANCE SHEET AND CAPITAL EXPOSURES |

|---|---|---|---|---|---|

| 1. | 2 936 | 1,06% | 1. | 3 200 | 1,16% |

| 2. | 2 856 | 1,03% | 2. | 2 887 | 1,05% |

| 3. | 2 450 | 0,88% | 3. | 2 450 | 0,89% |

| 4. | 2 332 | 0,84% | 4. | 2 371 | 0,86% |

| 5. | 1 895 | 0,68% | 5. | 2 065 | 0,75% |

| 6. | 1 747 | 0,63% | 6. | 1 583 | 0,57% |

| 7. | 1 602 | 0,58% | 7. | 1 571 | 0,57% |

| 8. | 1 566 | 0,56% | 8. | 1 482 | 0,54% |

| 9. | 1 322 | 0,48% | 9. | 1 435 | 0,52% |

| 10. | 1 101 | 0,40% | 10. | 1 081 | 0,39% |

| 11. | 819 | 0,30% | 11. | 992 | 0,36% |

| 12. | 796 | 0,29% | 12. | 956 | 0,35% |

| 13. | 746 | 0,27% | 13. | 883 | 0,32% |

| 14. | 724 | 0,26% | 14. | 872 | 0,32% |

| 15. | 708 | 0,26% | 15. | 828 | 0,30% |

| 16. | 682 | 0,25% | 16. | 774 | 0,28% |

| 17. | 655 | 0,24% | 17. | 761 | 0,28% |

| 18. | 650 | 0,23% | 18. | 705 | 0,26% |

| 19. | 636 | 0,23% | 19. | 672 | 0,24% |

| 20. | 566 | 0,20% | 20. | 618 | 0,22% |

| Total | 26 789 | 9,66% | Total | 28 184 | 10,21% |

1 off-balance sheet exposure includes the liability arising from derivative transactions in the amount equal to their balance sheet equivalent.

Concentration by the largest groups

The largest concentration of the PKO Bank Polski SA's Group’s exposure to a group of related borrowers amounted to 1.13% of the Group's loan portfolio (1.14% as at 31 December 2016). Only the clients of PKO Bank Polski SA are included in the five largest group.

As at 31 December 2017, the largest concentration of the Group’s exposure amounted to 9.2% of the recognized capital (10.2% as at 31 December 2016).

The Group’s exposure to the 5 largest capital groups:

| 31.12.2017 | 31.12.2016 | ||||

|---|---|---|---|---|---|

| No. | CREDIT EXPOSURES INCLUDE LOANS, ADVANCES, PURCHASED DEBT, DISCOUNTED BILL OF EXCHANGE, REALIZED GUARANTEES, INTEREST RECEIVABLES AND OFF-BALANCE SHEET AND CAPITAL EXPOSURES1 | SHARE IN THE LOAN PORTFOLIO, INCLUDING OFF-BALANCE SHEET AND CAPITAL EXPOSURES | No. | CREDIT EXPOSURES INCLUDE LOANS, ADVANCES, PURCHASED DEBT, DISCOUNTED BILL OF EXCHANGE, REALIZED GUARANTEES, INTEREST RECEIVABLES AND OFF-BALANCE SHEET AND CAPITAL EXPOSURES1 | SHARE IN THE LOAN PORTFOLIO, INCLUDING OFF-BALANCE SHEET AND CAPITAL EXPOSURES |

| 1. | 3 122 | 1,13% | 1. | 3 160 | 1,14% |

| 2. | 3 064 | 1,11% | 2. | 2 468 | 0,89% |

| 3. | 2 336 | 0,84% | 3. | 2 396 | 0,87% |

| 4. | 2 169 | 0,78% | 4. | 2 118 | 0,77% |

| 5. | 1 989 | 0,72% | 5. | 2 091 | 0,76% |

| Total | 12 680 | 4,57% | Total | 12 233 | 4,43% |

Concentration by industry

An increase in the Group's exposure to entities conducting economic activity is observed. The structure of the Group's exposure to industry sectors is dominated by entities operating in the Financial and insurance activities section.

The structure of exposure to industry sectors as at 31 December 2017 and 31 December 2016 is presented in the table below:

| SYMBOL | SECTION NAME | 31.12.2017 | 31.12.2016 | ||

|---|---|---|---|---|---|

| EXPOSURE | NUMBER OF ENTITIES | EXPOSURE | NUMBER OF ENTITIES | ||

| K | Financial and insurance activities | 15,01% | 2,07% | 14,57% | 2,07% |

| C | Industrial processing | 14,76% | 11,31% | 14,90% | 11,35% |

| L | Real estate administration | 10,61% | 16,61% | 12,54% | 17,09% |

| G | Wholesale and retail trade, repair of motor vehicles | 12,82% | 23,33% | 12,67% | 23,74% |

| O | Public administration and national defence, obligatory social security | 12,56% | 0,32% | 13,23% | 0,36% |

| Other exposures | 34,24% | 46,36% | 32,09% | 45,38% | |

| Total | 100,00% | 100,00% | 100,00% | 100,00% | |

The structure by industry presented above excludes the exposure arising from debt securities reclassified from ‘available-for-sale’ to ‘loans and advances to customers’.

Concentration by geographical regions

The Group's loan portfolio is diversified in terms of geographical concentration.

The structure of the loan portfolio by geographical regions is identified by the Group depending on the customer area – it is different for the Retail Market Area (ORD) and for the Corporate and Investment Banking Area (OKI).

In 2017, the largest concentration of the ORD loan portfolio was in the Warsaw region (warszawski) and Katowice region (katowicki) - these two regions account for around 26% of the total ORD portfolio(25% as at 31 December 2016.

| CONCENTRATION OF CREDIT RISK BY GEOGRAPHICAL REGION FOR RETAIL CUSTOMERS | 31.12.2017 | 31.12.2016 |

|---|---|---|

| warszawski | 15,09% | 14,35% |

| katowicki | 10,98% | 10,82% |

| poznański | 9,85% | 9,85% |

| krakowski | 8,94% | 9,06% |

| łódzki | 8,36% | 8,76% |

| wrocławski | 9,30% | 9,15% |

| gdański | 8,50% | 8,64% |

| bydgoski | 7,17% | 7,43% |

| lubelski | 6,90% | 6,87% |

| białostocki | 6,45% | 6,42% |

| szczeciński | 6,11% | 6,17% |

| Head Office | 0,81% | 0,83% |

| other | 0,76% | 0,84% |

| foreign countries | 0,78% | 0,81% |

| Szwecja | 0,00% | 0,00% |

| Total | 100,00% | 100,00% |

In 2017, the largest concentration of the OKI loan portfolio was in the central macroregion which accounted for 44% of the OKI portfolio (28% as at 31 December 2016).

| CONCENTRATION OF CREDIT RISK BY GEOGRAPHICAL REGION FOR CORPORATE CUSTOMERS | 31.12.2017 | 31.12.20161 |

|---|---|---|

| Head Office | 0,28% | 0,33% |

| central macroregion | 44,09% | 39,82% |

| northern macroregion | 10,69% | 12,32% |

| western macroregion | 10,99% | 12,16% |

| southern macroregion | 10,08% | 11,81% |

| south-eastern macroregion | 11,60% | 10,28% |

| north-eastern macroregion | 4,99% | 5,55% |

| south-western macroregion | 6,59% | 7,49% |

| other | 0,00% | 0,00% |

| foreign countries | 0,69% | 0,24% |

| Total | 100,00% | 100,00% |

1 The change in comparable data for 2016 relating to geographical concentration is due to a change in the algorithm used to attribute geographical location to the Head Office region.

Concentration of credit risk by currency

In accordance with recommendations S and T of the Polish Financial Supervision Authority, the Group applies internal limits associated with the loan exposures of the Group’s customers which determine the appetite for credit risk.

As at 31 December 2017 amounted to 62.38% , and as at 31 December 2016 it amounted to 69.48%.

| CONCENTRATION OF CREDIT RISK BY CURRENCY | 31.12.2017 | 31.12.2016 |

|---|---|---|

| PLN | 80,77% | 75,77% |

| Foreign currencies, of which: | 19,23% | 24,23% |

| CHF | 10,94% | 14,28% |

| EUR | 6,92% | 8,28% |

| USD | 0,88% | 1,10% |

| UAH | 0,39% | 0,38% |

| GBP | 0,04% | 0,04% |

| Total | 100,00% | 100,00% |

Other types of concentration

The Group analyses the structure of its housing loan portfolio by LTV levels. Both in 2017 and in 2016, the largest concentration was in the LTV range of 61%–80%.

| LOAN PORTFOLIO STRUCTURE BY LTV | 31.12.2017 | 31.12.2016 |

|---|---|---|

| 0% - 40% | 19,07% | 16,53% |

| 41%-60% | 22,72% | 19,01% |

| 61% - 80% | 33,80% | 27,30% |

| 81% - 90% | 16,21% | 17,52% |

| 91% - 100% | 4,02% | 9,10% |

| over 100% | 4,18% | 10,53% |

| Total | 100,00% | 100,00% |

In accordance with recommendations S and T of the Polish Financial Supervision Authority, the Group applies internal limits associated with the loan exposures of the Group’s customers which determine the appetite for credit risk.

As at 31 December 2017 amounted to 62.38% , and as at 31 December 2016 it amounted to 69.48%.

Forbearance practices

Forbearance is defined by the Group as actions aimed at amending the contractual terms agreed with a debtor or an issuer, forced by the debtor’s or issuer’s difficult financial situation (restructuring activities introducing concessions that otherwise would not have been granted). The aim of forbearance activities is to restore a debtor's or an issuer's ability to settle their liabilities towards the Group and to maximize the efficiency of managing non-performing loans, i.e. obtaining the highest possible recoveries while minimizing the costs incurred.

Forbearance consists in amending repayment terms which are agreed individually for each agreement. Such changes may consist in:

- dividing the debt due into instalments;

- changing the repayment scheme (fixed payments, degressive) payments);

- extending the loan period;

- changing interest rate;

- changing the margin;

- reducing the debt.

As a result of signing and repaying the amounts due under the forbearance agreement on a timely basis, a non-performing loan becomes performing. The forbearance process also involves evaluating the debtor's capacity to meet the terms of the settlement agreement on a timely basis (repayment of the debt at agreed dates). Forbearance agreements are monitored on an on-going basis. If impairment is recognized in relation to the related credit exposures, impairment allowances are recognized to reflect the impairment loss identified.

Forborne exposures classified as non-performing are included in the portfolio of performing exposures when the following conditions are met simultaneously:

- a receivable does not meet the condition of an individual impairment trigger and there is no impairment recognized;

- at least 12 months have passed from the conclusion of the restructuring agreement;

- the entire debt is covered by the restructuring agreement;

- the debtor demonstrated the capacity to fulfil the terms of the restructuring agreement.

Exposures cease to meet the criteria of a forborne exposure when all of the following conditions are met:

- at least 24 months have passed from the date of including the exposure in the portfolio of performing exposures (conditional period;

- as at the end of the conditional period referred to above, the customer has no debt towards the Group overdue for more than 30 days;

- at least 12 instalments have been repaid on a timely basis and in the amounts agreed.

Loans and advances to customers

| EXPOSURES SUBJECT TO FORBEARANCE IN THE LOAN PORTFOLIO | 31.12.2017 | 31.12.2016 |

|---|---|---|

| Loans and advances to customers, gross, of which: | 213 452 | 208 609 |

| subject to forbearance | 4 137 | 4 132 |

| Impairment allowances on loans and advances to customers, of which: | (7 823) | (8 003) |

| subject to forbearance | (1 083) | (988) |

| Loans and advances to customers, net, of which: | 205 629 | 200 606 |

| subject to forbearance | 3 054 | 3 144 |

| LOANS AND ADVANCES TO CUSTOMERS SUBJECT TO FORBEARANCE BY PRODUCT TYPE | CARRYING AMOUNT | |

|---|---|---|

| 31.12.2017 | 31.12.2016 | |

| Loans and advances to customers subject to forbearance, gross | 4 137 | 4 132 |

| corporate loans | 2 431 | 2 262 |

| housing loans | 1 416 | 1 563 |

| consumer loans | 290 | 307 |

| Impairment allowances on loans and advances to customers subject to forbearance | (1 083) | (988) |

| Loans and advances to customers subject to forbearance, net | 3 054 | 3 144 |

| LOANS AND ADVANCES TO CUSTOMERS SUBJECT TO FORBEARANCE, GROSS BY GEOGRAPHICAL REGION | 31.12.2017 | 31.12.2016 |

|---|---|---|

| Poland | 4 085 | 4 063 |

| mazowiecki | 1 040 | 700 |

| wielkopolski | 346 | 382 |

| śląsko-opolski | 441 | 497 |

| małopolsko-świętokrzyski | 289 | 323 |

| pomorski | 269 | 303 |

| podlaski | 197 | 278 |

| łódzki | 321 | 314 |

| dolnośląski | 299 | 308 |

| kujawsko-pomorski | 386 | 377 |

| zachodnio-pomorski | 257 | 337 |

| lubelsko-podkarpacki | 230 | 219 |

| warmińsko-mazurski | 9 | 25 |

| Ukraine | 52 | 69 |

| Total | 4 137 | 4 132 |

| LOANS AND ADVANCES TO CUSTOMERS SUBJECT TO FORBEARANCE - THE GROUP'S EXPOSURE TO CREDIT RISK | EXPOSURE BY CARRYING AMOUNT, GROSS | |

|---|---|---|

| 31.12.2017 | 31.12.2016 | |

| Loans and advances impaired | 2 229 | 2 250 |

| Loans and advances not impaired, of which: | 1 908 | 1 882 |

| not past due | 1 590 | 1 520 |

| past due | 318 | 362 |

| Total, gross | 4 137 | 4 132 |

Change in carrying amounts of loans and advances to customers subject to forbearance at the beginning and end of the period.

| CHANGE IN CARRYING AMOUNTS OF LOANS AND ADVANCES TO CUSTOMERS SUBJECT TO FORBEARANCE AT THE BEGINNING AND END OF THE PERIOD | 2017 | 2016 |

|---|---|---|

| Carrying amount as at the beginning of the period, net | 3 144 | 4 548 |

| Impairment allowance | (95) | 19 |

| Gross book value of loans and advances which ceased to meet the forbearance criteria during the period | (700) | (1 990) |

| New loans and advances recognized in the period, gross | 1 380 | 1 084 |

| Other changes/repayment | (662) | (514) |

| Foreign exchange differences | (13) | (3) |

| Carrying amount as at the end of the period, net | 3 054 | 3 144 |

| LOANS AND ADVANCES TO CUSTOMERS SUBJECT TO FORBEARANCE BY TYPE OF CHANGES IN TERMS OF REPAYMENT | CARRYING AMOUNT, GROSS | |

|---|---|---|

| 31.12.2017 | 31.12.2016 | |

| Dividing the debt due into instalments | 2 365 | 2 745 |

| Change in the repayment scheme (fixed payments, degressive) | 1 671 | 1 867 |

| Extension of the loan period | 1 700 | 1 431 |

| Change in interest rate | 772 | 600 |

| Change in margin | 896 | 536 |

| Debt reduction | 150 | 114 |

| Other terms | 72 | 81 |

More than one change in the terms and condition of repayment may be applied to a forborne exposure.

The amount of recognized interest income on forborne loans and advances to customers for the period ended 31 December 2017 amounted to PLN 141 million (PLN 161 million for the period ended 31 December 2016).

Available-for-sale investment securities subject to forbearance

| EXPOSURES SUBJECT TO FORBEARANCE IN THE PORTFOLIO OF AVAILABLE-FOR-SALE INVESTMENT SECURITIES | 31.12.2017 | 31.12.2016 |

|---|---|---|

| Available-for-sale debt securities, gross, of which | 43 441 | 36 419 |

| subject to forbearance | 1 050 | 1 303 |

| Impairment allowances on available-for-sale investment securities, of which: | (249) | (277) |

| subject to forbearance | (246) | (274) |

| Available-for-sale investment securities, net, of which: | 43 192 | 36 142 |

| subject to forbearance | 804 | 1 029 |

| AVAILABLE-FOR-SALE INVESTMENT SECURITIES SUBJECT TO FORBEARANCE – THE GROUP'S EXPOSURE TO CREDIT RISK | EXPOSURE BY CARRYING AMOUNT, GROSS | |

|---|---|---|

| 31.12.2017 | 31.12.2016 | |

| Available-for-sale investment securities, impaired | 819 | 1 303 |

| Available-for-sale investment securities, not impaired | 231 | - |

| Total, gross | 1 050 | 1 303 |

| CHANGE IN CARRYING AMOUNTS OF AVAILABLE-FOR-SALE INVESTMENT SECURITIES SUBJECT TO FORBEARANCE AT THE BEGINNING AND END OF THE PERIOD | 2017 | 2016 |

|---|---|---|

| Carrying amount as at the beginning of the period, net | 1 029 | 350 |

| Impairment allowance (change during the period) | 28 | (221) |

| New available-for-sale investment securities recognized in the period, gross | - | 900 |

| Other changes/repayment | (253) | - |

| Carrying amount as at the end of the period, net | 804 | 1 029 |

| INVESTMENT SECURITIES SUBJECT TO FORBEARANCE, GROSS, BY TYPE OF CHANGES IN REPAYMENT TERMS | Carrying amount, gross | |

|---|---|---|

| 31.12.2017 | 31.12.2016 | |

| Dividing the debt due into instalments | 1 050 | 1 204 |

| Change of the repayment scheme | 1 050 | 716 |

| Extension of the loan period; | 1 050 | 716 |

| Change in interest rate | 819 | 716 |

| Change in margin | 819 | 716 |

| Debt reduction | 133 | 129 |

Exposure to the counterparty credit risk

Credit risk of financial institutions on the wholesale market

CONCENTRATION OF CREDIT RISK – INTERBANK MARKET – EXPOSURE TO INTERBANK MARKET AS AT 31.12.20171 | ||||||

|---|---|---|---|---|---|---|

Counterparty | TYPE OF INSTRUMENT | TOTAL | ||||

COUNTRY | RATING | INVESTMENT (NOMINAL VALUE) | DERIVATIVES (MARKET VALUE, EXCLUDING COLLATERAL IF POSITIVE) | SECURITIES (NOMINAL VALUE) | ||

Counterparty 1 | Belgium | BBB | 692 | (6) | - | 692 |

Counterparty 2 | Germany | AA | 592 | - | - | 592 |

Counterparty 3 | Belgium | A | 480 | - | - | 480 |

Counterparty 4 | Poland | A | - | - | 400 | 400 |

Counterparty 5 | Austria | BBB | 396 | - | - | 396 |

Counterparty 6 | China | A | 332 | - | - | 332 |

Counterparty 7 | Supranational institution | AAA | 170 | 16 | 130 | 316 |

Counterparty 8 | Sweden | AA | 190 | 84 | - | 274 |

Counterparty 9 | Austria | A | 209 | - | - | 209 |

Counterparty 10 | France | A | - | 171 | - | 171 |

Counterparty 11 | Poland | A | - | - | 150 | 150 |

Counterparty 12 | UK | AA | - | 120 | - | 120 |

Counterparty 13 | US | A | 115 | - | - | 115 |

Counterparty 14 | US | AA | - | 103 | - | 103 |

Counterparty 15 | France | A | - | 88 | - | 88 |

Counterparty 16 | Poland | BBB | 10 | 44 | - | 54 |

Counterparty 17 | Denmark | A | 50 | (3) | - | 50 |

Counterparty 18 | Poland | A | - | 47 | - | 47 |

Counterparty 19 | Germany | BBB | - | 42 | - | 42 |

Counterparty 20 | Germany | A | - | 29 | - | 29 |

1 Excluding exposures to the State Treasury and the National Bank of Poland

| CONCENTRATION OF CREDIT RISK – INTERBANK MARKET – EXPOSURE TO INTERBANK MARKET AS AT 31.12.20161 | ||||||

|---|---|---|---|---|---|---|

| Counterparty | TYPE OF INSTRUMENT | TOTAL | ||||

| COUNTRY | RATING | INVESTMENT (NOMINAL VALUE) | DERIVATIVES (MARKET VALUE, EXCLUDING COLLATERAL IF POSITIVE) | SECURITIES (NOMINAL VALUE) | ||

| Counterparty 4 | Poland | A | - | - | 900 | 900 |

| Counterparty 69 | Switzerland | AA | 494 | - | - | 494 |

| Counterparty 1 | Belgium | BBB | 398 | 7 | - | 405 |

| Counterparty 70 | Switzerland | AA | 397 | - | - | 397 |

| Counterparty 6 | Luxembourg | A | 323 | - | - | 323 |

| Counterparty 5 | Austria | BBB | 288 | - | - | 288 |

| Counterparty 71 | Norway | A | 167 | - | - | 167 |

| Counterparty 7 | Luxembourg | AAA | - | (19) | 155 | 155 |

| Counterparty 14 | US | AA | - | 132 | - | 132 |

| Counterparty 72 | UK | A | - | 110 | - | 110 |

| Counterparty 18 | Poland | A | 100 | (36) | - | 100 |

| Counterparty 16 | Poland | BBB | - | 65 | - | 65 |

| Counterparty 20 | Germany | A | - | 45 | - | 45 |

| Counterparty 40 | UK | A | - | 40 | - | 40 |

| Counterparty 25 | France | A | - | 38 | - | 38 |

| Counterparty 73 | Poland | BB | - | 34 | - | 34 |

| Counterparty 23 | Poland | NONE | 20 | 1 | - | 21 |

| Counterparty 56 | Poland | BB | - | 12 | - | 12 |

| Counterparty 49 | UK | AAA | - | 10 | - | 10 |

| Counterparty 29 | Poland | BBB | - | 10 | - | 10 |

1 Excluding exposures to the State Treasury and the National Bank of Poland

As at 31 December 2017 and 31 December 2016, the Group had access to two clearing houses (as an indirect participant in one, and as a direct participant in the other) through which the Bank settled interest rate derivatives referred to in the EMIR Regulation (Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, including the related delegated and executive regulations) with selected domestic and foreign counterparties. In nominal terms, the share of transactions cleared centrally was 70% of the entire IRS/OIS portfolio, and in the case of FRA, all transactions were submitted for clearing to clearing houses.

As at 31 December 2017, the Group had framework agreements under the ISDA/ZBP standard signed with 22 domestic banks and 66 foreign banks and credit institutions, and CSA/ZBP collateral agreements with 21 domestic banks and 64 foreign banks and credit institutions. In addition, the Group was a party to 27 repo agreements (under the GMRA/ZBP standard). As at 31 December 2016, the Group had framework agreements under the ISDA/ZBP standard signed with 23 domestic banks and 62 foreign banks and credit institutions, and CSA/ZBP collateral agreements with 21 domestic banks and 52 foreign banks and credit institutions. In addition, the Group was a party to 22 repo agreements (under the GMRA/ZBP standard).

Credit risk of financial institutions on the non-wholesale market

In addition to the interbank market exposure, as at 31 December 2017 and 31 December 2016, the Group had an exposure to financial institutions on the non-wholesale market (e.g. loans granted, bonds purchased outside the interbank market).

The structure of exposures exceeding PLN 10 million is presented in the table below:

| 2017 | Nominal exposure | Country of the counterparty's registered office | |

|---|---|---|---|

| balance sheet | off-balance sheet | ||

| Counterparty 22 | 44 | - | Poland |

| Counterparty 21 | 50 | - | Poland |

| Counterparty 8 | 27 | 25 | Sweden |

| Counterparty 14 | - | 60 | US |

For comparison, the structure of exposure over PLN 10 million as at 31 December 2016 is presented in the table below:

| 2016 | Nominal exposure | Country of the counterparty's registered office | |

|---|---|---|---|

| balance sheet | off-balance sheet | ||

| Counterparty 4 | 500 | - | Poland |

| Counterparty 22 | 89 | - | Poland |

| Counterparty 21 | 50 | - | Poland |

| Counterparty 8 | - | 20 | Denmark |

| Counterparty 14 | - | 60 | US |

Risk management of foreign currency risk associated with mortgage loans for households

The Group analyses its portfolio of foreign currency mortgage loans to households in a specific manner. The Group monitors the quality of the portfolio on an on-going basis and reviews the risk of deterioration in the quality of the portfolio. Currently, the quality of the portfolio is at an acceptable level. The Group takes into consideration the risk of foreign currency mortgage loans for households in the capital adequacy and own fund management.

The tables below present an analysis of the quality of loans denominated in CHF.

| LOANS AND ADVANCES TO CUSTOMERS IN CHF BY METHOD OF CALCULATING IMPAIRMENT ALLOWANCES (translated into PLN at the exchange rate of 1 CHF = 3.5672) | 31.12.2017 | |||

|---|---|---|---|---|

| Financial institutions | Corporates | Households | Total | |

| Assessed on an individual basis, of which: | - | 113 | 102 | 215 |

| impaired | - | 104 | 90 | 194 |

| Assessed on a portfolio basis, impaired | - | 17 | 1 041 | 1 058 |

| Assessed on a group basis (IBNR) | 2 | 270 | 23 277 | 23 549 |

| Loans and advances to customers, gross | 2 | 400 | 24 420 | 24 822 |

| Impairment allowances on exposures assessed on an individual basis, of which: | - | (51) | (42) | (93) |

| impaired | - | (51) | (42) | (93) |

| Impairment allowances on exposures assessed on a portfolio basis | - | (14) | (749) | (763) |

| Impairment allowances on exposures assessed on a group basis (IBNR) | - | (3) | (49) | (52) |

| Total impairment allowances on exposures | - | (68) | (840) | (908) |

| Loans and advances to customers, net | 2 | 332 | 23 580 | 23 914 |

| LOANS AND ADVANCES TO CUSTOMERS IN CHFnBY METHOD OF CALCULATING IMPAIRMENT ALLOWANCES (translated into PLN at the exchange rate of 1 CHF = 4.1173) | 31.12.2016 | |||

|---|---|---|---|---|

| Financial institutions | Corporates | Households | Total | |

| Assessed on an individual basis, of which: | - | 247 | 166 | 413 |

| impaired | - | 220 | 137 | 357 |

| Assessed on a portfolio basis, impaired | - | 26 | 1 184 | 1 210 |

| Assessed on a group basis (IBNR) | 5 | 361 | 29 361 | 29 727 |

| Loans and advances to customers, gross | 5 | 634 | 30 711 | 31 350 |

| Impairment allowances on exposures assessed on an individual basis, of which: | - | (90) | (64) | (154) |

| impaired | - | (63) | (64) | (127) |

| Impairment allowances on exposures assessed on a portfolio basis | - | (19) | (793) | (812) |

| Impairment allowances on exposures assessed on a group basis (IBNR) | - | (2) | (70) | (72) |

| Total impairment allowances on exposures | - | (111) | (927) | (1 038) |

| Loans and advances to customers, net | 5 | 523 | 29 784 | 30 312 |

| LOANS AND ADVANCES TO CUSTOMERS ASSESSED ON A GROUP BASIS (IBNR) | 31.12.2017 | ||

|---|---|---|---|

| PLN | CHF | Other currencies | |

| Loans and advances to customers, gross | 162 281 | 23 549 | 14 848 |

| past due | 3 715 | 512 | 830 |

| not past due | 158 566 | 23 037 | 14 018 |

| Impairment allowances on exposures assessed on a group basis (IBNR) | (518) | (52) | (150) |

| past due | (138) | (27) | (11) |

| not past due | (380) | (25) | (139) |

| Loans and advances to customers, net | 161 763 | 23 497 | 14 698 |

| LOANS AND ADVANCES TO CUSTOMERS ASSESSED ON A GROUP BASIS (IBNR) | 31.12.2016 | ||

|---|---|---|---|

| PLN | CHF | Other currencies | |

| Loans and advances to customers, gross | 147 632 | 29 727 | 17 516 |

| past due | 3 149 | 658 | 510 |

| not past due | 144 483 | 29 069 | 17 006 |

| Impairment allowances on exposures assessed on a group basis (IBNR) | (457) | (72) | (100) |

| past due | (147) | (35) | (11) |

| not past due | (310) | (37) | (89) |

| Loans and advances to customers, net | 147 175 | 29 655 | 17 416 |

| LOANS AND ADVANCES TO CUSTOMERS ASSESSED ON A GROUP BASIS (IBNR) SUBJECT TO FORBEARANCE, BY CURRENCY | 31.12.2017 | ||

|---|---|---|---|

| PLN | CHF | Other currencies | |

| Loans and advances to customers subject to forbearance, gross | 1 055 | 397 | 232 |

| Impairment allowances on exposures assessed on a group basis (IBNR) subject to forbearance | (57) | (14) | (5) |

| Loans and advances to customers subject to forbearance, net | 998 | 383 | 227 |

| LOANS AND ADVANCES TO CUSTOMERS ASSESSED ON A GROUP BASIS (IBNR) SUBJECT TO FORBEARANCE, BY CURRENCY | 31.12.2016 | ||

|---|---|---|---|

| PLN | CHF | Other currencies | |

| Loans and advances to customers subject to forbearance, gross | 941 | 557 | 162 |

| Impairment allowances on exposures assessed on a group basis (IBNR) subject to forbearance | (33) | (21) | (7) |

| Loans and advances to customers subject to forbearance, net | 908 | 536 | 155 |

As at 31 December 2017, the average LTV for the portfolio of CHF-denominated loans amounted to 67.00% (82.7% as at 31 December 2016) compared with the average LTV for the entire loan portfolio of 62.38% (69.5% as at 31 December 2016).