In 2017, the PKO Bank Polski SA Group continued sustained development in the area of retail segment customers, focused on identifying and satisfying the needs of its customers with whom it builds strong, long-term relationships. It took initiatives aimed at increasing quality of service, among other things, through activities leading to increased innovation in respect of new financial solutions, both in respect of products and distribution channels, in particular with regard to electronic banking and mobile payments.

Customers of the segment

At the end of 2017, the retail segment served 9.5 million customers, of which 9.0 million were individuals.

Due to the wide distribution network, the majority of the Bank’s customers live in municipalities of less than 100k inhabitants. The trustworthy brand of the Bank, the ability to combine tradition with modernity and the transparent product offer that takes into account customer preferences which change with time, make the Bank recognizable also in large urban centres. What is more, in terms of the demographic profile, nearly half of the individual customers are customers aged under 45.

The network of branches remains the most important distribution channel from the perspective of the number of retail customers gained. New customers are acquired mainly through the sale of current accounts.

The proportion of the segment’s customers using mobile and internet banking is continually growing. As at the end of 2017, internet banking was actively used by 3.8 million customers, and nearly 2.6 million customers of the Bank logged into the Bank from their mobile device at least once a month.

Number of active iPKO accounts (in millions)

Number of active users of mobile banking* (in millions)

The loan offer in the retail segment

The PKO Bank Polski SA offer covers a wide range of credit products. Individuals can take advantage of the financing offered under:

- consumer loans available in the form of cash loans, mortgage-backed loans, revolving loans and credit cards;

- housing loans.

The credit offer for small- and medium-sized enterprises is available in the form of:

- investment and investor loans;

- working capital loans;

- leasing and factoring.

Structure of retail segment loans as at 31/12/2017

As at the end of 2017, the aggregate financing of retail segment customers amounted to PLN 157 billion and went up by over PLN 3 billion (i.e. 2.1%) since the start of the year.

This was mainly due to the growth of the portfolio of retail and private banking loans (PLN +1.7 billion) and lease receivables (PLN +1.9 billion). Additionally, the increase in the portfolio of PLN mortgage-based loans was almost completely offset by a decrease in the volume of foreign currency loans, which remained under the significant influence of the foreign exchange effect.

Retail and private banking loans

Retail customers can use both standard cash loans and the current financing available under revolving loans and credit cards. Since May 2017, the Bank has a lease product PKO Zawsze Nowe Auto in its offer to retail customers, which is an alternative to a bank loan or buying a car for cash.

Loans in the retail segment (in PLN billion)

PKO Bank Polski SA systematically takes measures to increase effective access to the credit offer for retail and private banking customers, regardless of the distribution channel. As part of the activities performed:

- regular customers can obtain a loan to an account within 30 minutes in the form of a personalized offer;

- the interest rate formula has been changed for newly concluded cash loan agreements;

- the availability of the revolving loan was increased and the amount to which collateral is not applied was raised to PLN 120 thousand.

In 2017, PKO Bank Polski SA continued its activities supporting sales of consumer loans, and apart from offering attractive pricing terms, enabled access to cash thanks to fast decisions with a minimum of formalities, among others, as part of marketing campaigns entitled:

- “Wybierz swoją drogę do Mini Ratki” – promoting a multichannel offer addressed to customers looking for short-term financing, a fast lending decision and minimum formalities;

- “Pozwól Mini Ratce ścisnąć twoje raty” – promoting the consolidation of loans from outside PKO Banku Polski SA;

- “Jej wygodność Mini Ratka” – promoting a loan of up to PLN 24 thousand without the need to provide an employment certificate level of income – based on a personal ID document and bank statement from the last three months;

- “Mini Ratka na spełnienie życzeń” – promoting express payment of cash and 0% commission up to PLN 10 thousand.

Mortgage banking loans

The PKO Bank Polski SA has been a long-term leader in financing the housing needs of people in Poland.

According to data presented by the Polish Bank Association, at the end of 2017, the Bank’s Group was the first on the market with a 29.6% share in sales of housing loans for individuals. In 2017, loans were granted for a total of PLN 13 billion.

Share of housing loans to individuals in new sales*

Retail segment customers may avail themselves of flagship mortgage products known as “WŁASNY KĄT”, also available in the “Mieszkanie dla Młodych” programme. In 2017, PKO Bank Polski SA granted more than 4.8 thousand loans for a total amount of PLN 0.8 billion as part of the “Mieszkanie dla Młodych” programme. The programme consists of providing additional financing from the State Budget to customers’ own contributions and granting additional financial support in the form of repaying a part of the loan.

PKO Bank Polski SA strives to provide customers not only with the widest range of credit products but also to offer attractive prices for mortgage products. In the fourth quarter of 2017, the offer supporting borrowers with CHF mortgage loans was extended until 30 June 2018. The purpose of the offer is to reduce the negative effects of the change in the exchange rate of this currency.

Loans for small- and medium-sized enterprises

The PKO Bank Polski SA Group consistently supports Polish entrepreneurship. Companies from the sector of small- and medium-sized enterprises are provided with funding for current and investment needs through a wide and flexible credit offer. Thanks to the agreement “Portfelowa Linia Gwarancyjna de minimis” (“De minimis Guarantee Line for the Portfolio”) and “Portfelowa Linia Gwarancyjna COSME” (“COSME Portfolio Guarantee Line”) signed between PKO Bank Polski SA and Bank Gospodarstwa Krajowego (BGK) as part of the government and EU aid programme for small- and medium-sized enterprises, entrepreneurs receive support in the form of BGK de minimis guarantees and guarantees with counter guarantees granted by the European Investment Fund under the COSME programme. The aim is to increase the availability of credit and activate additional resources for the company’s current operations.

In 2017, PKO Bank Polski SA remained the largest lender among 21 banks granting loans with de minimis guarantees and obtained a 20.5% market share, therefore each year maintaining the leader’s position in sales. The Bank granted total guarantees of approx. PLN 9.2 billion and in 2017 was awarded a prize by Bank Gospodarstwa Krajowego for its share in the total value of guarantees granted since the beginning of the programme’s operation, i.e. since March 2013. The prize was presented during the conference “Gwarancje BGK na rzecz odpowiedzialnego rozwoju MŚP” (“BGK guarantees for responsible development of the SME”).

The cooperation between the Bank and BGK within the scope of the offer for small- and medium-sized enterprises is developing systematically. Apart from the de minimis guarantees, entrepreneurs who are the Bank’s customers can avail themselves of the security of repayment for revolving loans, cash loans or investment loans with guarantees under the PLG COSME programme. The amount of the loans granted under the “COSME Portfolio Guarantee Line” as at 31 December 2017 was nearly PLN 254 million and the amount of the guarantee granted was over PLN 201 million.

In 2017, PKO Bank Polski SA introduced the following changes and improvements to its lending offer dedicated to entrepreneurs.

- the Bank created a product called “Pożyczka na Start” – a loan for persons starting a business with a maximum lending period of 60 months and maximum amount of PLN 100 thousand. The characteristics of the products are as follows: an easy and fast way of obtaining money, flexibility of repayment and spending of funds – the funds obtained can be used for any purpose related to the business activities, without the need to present invoices;

- the credit period was extended from 12 to 24 months for the Biznes Partner overdraft granted to individual farmers, provided that tangible collateral is established at 60%;

- for the SME revolving loan, the Bank introduced the possibility of applying an individualized schedule of repayment, adapted to the inflows obtained on the performance of a contract.

Deposits in retail segment (in PLN billion)

Leasing and factoring for small- and medium-sized enterprises

As part of the Bank’s Group offer, customers from the small and medium-sized enterprises sector may avail themselves of lease products and services. Fixed assets are financed through a lease, depending on customer needs, including:

- vehicles, plant and machinery;

- investment projects (e.g. telephone lines);

- office equipment and furniture;

- computer hardware;

- medical equipment;

- agricultural tools and machines;

- real estate.

Apart from the standard products, the offer comprises fleet leasing services and cooperation with suppliers.

As at the end of 2017, lease receivables in the retail segment amounted to PLN 9.2 billion and increased more than 25% over the year.

Lease receivables in the retail segment (in PLN billion)

To make the offer more attractive in 2017, the Bank’s Group introduced:

- “PKO Turboleasing” – an innovative product enabling the leasing of equipment and devices needed by entrepreneurs available in the internet shops. This solution provides the possibility of applying for a lease online. The entire process ensures transaction safety and freedom without leaving home. The lending decision is instantaneous, even 15 minutes from the moment of submitting the application. The customer chooses the place where the agreement is to be signed – in the partner’s shop or via a courier. The lease offer covers any chosen object for orders above PLN 2,000 net.

- “Leasing na Start” – for the financing of new or recently formed enterprises up to PLN 120 thousand for new and used cars or trucks up to 3.5 tonnes, available in the Bank’s network and in the branches of PKO Leasing SA.

“Pożyczka na Start” in association with “Leasing na Start” is an element of a wider campaign entitled “Mój bank działa na moje konto” (“My bank is acting on my account”) undertaken by the Bank’s Group to help small and medium-sized enterprises conduct business activities.

Deposit and investment offer

The Bank’s Group encourages customers to save over a long term, both through a varied product offer (including regular saving products, term deposits, investment products of PKO Towarzystwo Funduszy Inwestycyjnych SA and Treasury bonds) and through educational and information activity.

In 2017, PKO Bank Polski SA continued actions aimed at making the deposit offer more attractive for retail segment customers, in line with the current market situation and competitive position.

As at 31 December 2017, retail segment deposits amounted to PLN 167 billion and their balance from the start of the year increased by PLN 3.9 billion (i.e. 2.4%). This was due to an increase in retail and private banking deposits, mainly current deposits, accompanied by a decrease in term deposits. The level of deposits of small and medium-sized enterprises also increased during the year.

Current saving accounts

In 2017, PKO Bank Polski SA strengthened its leader’s position on the market in terms of the number of current accounts maintained, which amounted to 7.1 million as at 31 December 2017 and increased by more than 280 thousand during the year.

Number of current accounts (in thousands)

The continually growing number of accounts of individuals is the effect of a diversified offer taking into account customer preferences, including the following products:

- PKO Konto bez Granic – offering a number of attractive services, including withdrawals from ATMs in Poland and anywhere in the world as part of only one fee;

- PKO Konto na Zero – an account and card for PLN 0 if actively used;

- Aurum and Platinium II account – dedicated to customers of Private Banking;

Customer trust is not only an effect of the brand’s recognisability and tailored product offer but also of applying leading edge technology. The Bank leaves a transaction service and a mobile application at the disposal of each account holder enabling access to the account at any time of the day or night, the possibility of paying by card, by telephone or even a watch or a pendant with a pay pass function.

In 2017, the Bank launched instantaneous transfers for its customers in the Express Elixir system, which are made to selected banks within a few seconds of the transaction’s approval. The transfers can be made at any time – they operate 24 hours a day, 7 days a week, throughout the year.

Children and their parents are a particularly important group of customers for which new products and services are being developed. The intensive development of the offer to the young and youngest customers is based on modern banking with a multi-channelled access, security and a wide educational context. The youngest customers have an opportunity to become acquainted with the banking world from the inside, using financial tools tailored to their needs.

Structure of retail segment deposits as a 31/12/2017

The Bank’s offer for young people is a diversified, modern and competitive range of products, comprising among other things:

- saving books for children as part of Szkolna Kasa Oszczędnościowa (SKO) for primary school pupils; savg

- PKO Junior – with a special account for a child, the internet banking service, the mobile application and payment cards;

- PKO Konto dla Młodych – a fully internet and mobile account for persons aged 16–18;

- PKO Konto Pierwsze – an account for persons aged 13–18 with an IKO mobile application.

PKO Bank Polski SA offers two packages to customers from the small- and medium-sized enterprise sector who are interested in comprehensive, modern and attractively priced services:

- PKO Konto Firmowe – to individuals running a business, freelancers and farmers who appreciate that the finances of their firms are handled using modern electronic banking services and through an individual advisor at the Bank’s branch.

- PKO Rachunek dla Biznesu – created for entrepreneurs who are looking for an offer ideally tailored to their needs and who value a relationship with an individual bank advisor. To holders of the PKO Rachunek dla Biznesu account, the Bank offers access to advanced internet banking iPKO biznes and to all cash-management services, low transaction costs for transactions realized via the Internet and many more modern banking products and services, including the cheapest on the market SEPA online transfers and access to simple currency exchange thanks to the free iPKO dealer platform.

In 2017, the Bank created an automatic connection with the register of the Central Register and Information on Economic Activity (CEIDG) operated by the Ministry of Development. Thanks to downloading data directly from the CEIDG, the process of opening a corporate account has been simplified and accelerated.

Term deposits and regular saving products

The deposits of retail and private banking customers have a dominant share in the retail segment deposits. The Bank offers, among other things, deposits with progressive and standard interest rates and structured deposits to its individual customers.

The most popular term deposits in the Bank’s offer for retail and banking customers in 2017 were:

- offered in the first half of 2017: 12M online deposit, 12M deposit for new funds and 12M deposit with trigger point interest rate;

- 6M deposits;

- term deposit saving account available in 1M 3M, 6M or 12M tenors;

- 3M deposit for new funds.

The Bank also has structured instruments in its offer dedicated to individual customers. In 2017, the Bank conducted 22 subscriptions for structured deposits, which included:

- deposits based on the USD/PLN exchange rate (18-month with guaranteed 1% interest and 36-month with guaranteed 2% interest over the life of the product, 18-month with guaranteed 0.9% interest and 36-month with guaranteed 1.8% interest over the life of the product).

- deposits based on the EUR/PLN exchange rate (18-month with guaranteed 0.9% interest, 18-month with guaranteed 1% interest, 36-month with guaranteed 1.8% interest and 36-month with guaranteed 2% interest over the life of the product);

- 36-month structured deposit based on the basket of shares of companies related to the gold extraction sector.

Value of managed non-dedicated IF assets (in PLN billion)*

In 2017, the product offer for long-term saving was regenerated. As a result, the term saving deposits offered so far (Kapitał na Marzenia, Kapitał na Emeryturę, Kapitał na Własny Kąt, Kapitał dla Dziecka) were replaced with a new product: a term deposit saving account – Program Budowania Kapitału. The change in the offer in this product group resulted from observations made on the market and from the needs of customers who used the Bank’s former offer for saving regularly.

Investment funds

The Bank’s Group offers 66 non-dedicated funds to the customers of retail and private banking in which assets amounting to PLN 27.4 billion have been accumulated. The wide offer of investment funds provides access to various classes of assets, geographical areas and strategy types. The individual funds are characterized by a different level of risk, recommended investment horizon and assumed returns.

Sales of Treasury bonds

PKO Bank Polski SA has exclusive rights to sell and service retail bonds issued by the State Treasury, under an agreement concluded with the Minister of Finance. Treasury bonds are sold through the sales network of PKO Bank Polski SA, which is of great convenience for all those who wish to invest in these instruments. In 2017, almost 69 million bonds were sold (46 million in 2016).

Other products and services in the retail segment

Number of bank cards (in thousands)

Bank cards

As at the end of 2017, the number PKO Bank Polski SA cards was approx. 8.3 million, including 0.9 million credit cards.

The Bank’s offer comprises a number of bank cards, which take into account the customers’ needs, including:

- the PKO Ekspres debit card – giving easy access to funds accumulated on accounts and free-of-charge use of the ATMs of PKO Bank Polski SA, also available in the form of a sticker, pendant or a contactless payment watch;

- Karta PKO Junior – the first prepaid contact and contactless card in Poland, which can also be used by children under 13;

- multi-currency card – one intelligent card to 8 accounts, including PLN and 7 currency accounts: EUR, GBP, USD, CHF, DKK, NOK and SEK;

- currency card – available to holders of saving accounts in USD, EUR and GBP;

- credit cards – there are 10 types of credit cards in the offer and they have been constructed to meet the needs of various customer groups, depending on their preferences and financial potential.

The customers can also use HCE cards. As at the end of 2017, PKO Bank Polski SA handled 155 thousand active virtual contactless cards, which enabled payments from mobile devices;

Insurance products

The PKO Bank Polski SA Group continuously develops its offer of insurance products increasing the attractiveness of the banking products combined with them and giving the customers an opportunity to provide security for their liabilities and assets and to receive held in an event of emergency. The Bank’s Group addresses its insurance services to retail and private banking customers and customers from the small- and medium-sized enterprise segment and corporate banking. These are largely insurance products relating to the following bank products:

- consumer and mortgage loans (life insurance and insurance on loss of source of income, real estate and movable property insurance, third party liability insurance, assistance, low contribution insurance and insurance of SME loan repayment);

- current accounts (ROR) (including life insurance, accident insurance and assistance);

- bank cards (including security package to credit cards, travel insurance, loan repayment insurance).

Insurance contribution minus refunds (in PLN million)

In 2017, the PKO Bank Polski SA Group introduced into its offer insurance unrelated to bank products, available in the mobile iPKO and IKO channels. These include:

- life insurance “Moje Życie24”;

- real estate insurance “Mój Dom24”;

- travel insurance “Moje Podróże24”.

The insurance offer was prepared for holders of current accounts (ROR) in response to the needs of customers who value attractive pricing terms and the opportunity of simple, fast purchase of insurance, without the need to leave home.

The offer of PKO Bank Polski SA in 2017 was additionally enriched for new insurance products:

- insurance of short-term receivables – KUKE Polisa na świat, a product delivered by KUKE SA;

- life insurance to Mortgage Loans offered by PKO Życie TU SA.

Moreover, the responsibility for foreign travel insurance for cards has been taken over by PKO TU SA.

In the second half of 2017, the Group implemented a new distribution model for insuring leased assets. At the same time, PKO Bank Polski SA renewed its insurance offer for customers in this segment. At present, the scope of insurance which a customer of PKO Leasing SA may obtain via the Bank includes:

- automotive insurance provided by insurance companies from outside the Bank’s Group;

- real estate insurance from PKO TU SA;

- GAP insurance in the event of financial loss (invoice, index, casco) in cooperation with PKO TU SA.

Since 2017, insurance with the capital fund has been withdrawn from PKO Bank Polski SA’s offer. In the past year the Group undertook intensive work to implement the changes arising from the requirements of the Act on insurance distribution.

Private banking

PKO Bank Polski SA is consistently developing its Private Banking segment, focusing on close cooperation within the Bank’s Group, enabling customers to access a wide range of products and financial instruments. The Private Banking Offices serve customers from Poland’s nine largest cities: Warsaw, Gdańsk, Kraków, Katowice, Poznań, Wrocław, Łódź, Szczecin and Bydgoszcz (opened as a part of the Private Banking Office in Gdańsk). As at the end of 2017, the Private Banking Centre managed a portfolio of assets with a value of PLN 22.3 billion (PLN 15.8 billion as at the end of 2016).

Electronic banking

Number of retail segment customers with access ti iPKO (in millions)

Customers of the retail segment can use a package of electronic banking services under the name iPKO, and small and medium-sized enterprises can avail themselves of iPKO Biznes electronic banking services. These services provide customers with access to information on their accounts and products, and enable them to effect transactions through the Internet, self-service terminals and by telephone. As at the end of 2017, the number of customers with access to iPKO was 9.8 million.

The Bank systematically promotes the remote use of an Internet account, self-service in account and bank product management in the transaction service, which gives customers faster and easier access to their products and reduces the cost of banking services.

In 2017, the Bank introduced the following new solutions to its offer:

- made available a service in iPKO which allows for an entirely remote process for opening and managing Pierwsze Konto Oszczędnościowe (First Saving Account) dedicated to children and young people aged 0–18 and their parents;

- introduced the possibility of ordering a new debit card in iPKO with a city-card function (for Warsaw and Wrocław), replacing the former traditional card with a card with a city-card function and opening a new account on the Bank’s website and at the same time ordering a debit card with a city-card function;

- implemented a service to set up a credit card as a means of payments for the service Płacę z iPKO and Płacę z Inteligo, which enables faster, more convenient and safer shopping through the Internet.

- extended its offer with a new insurance product Moje Życie24, available solely in iPKO and addressed to holders of current accounts (ROR);

- enabled customers to manage their own daily limits of electronic transactions to be effected through the Inteligo online service, mobile and telephone service.

- introduced the possibility of opening a Trusted Profile through iPKO electronic banking and the Inteligo account and thereby making use of additional services, including the e-service “Sprawdź swoje punkty karne” (“Check the number of your penalty points for bad driving”);

- introduced the possibility of temporarily blocking a debit or a credit card;

- introduced the possibility of applying for a credit card through iPKO together with signing an agreement for issuing and using the card; and for card holders – the possibility of applying for a card limit increase;

- introduced the possibility of recharging prepaid energy metres through the iPKO service – this service supports state-of-the-art market propositions in the energy sector. The pre-paid metres can be recharged using any card, and the amount is then translated into a specific amount of energy. After providing the metre number in the iPKO service, the Bank recognizes the energy supplier on its own. Users who avail themselves of two-zone solutions can also divide the amount of the recharge into amounts for day and night;

- introduced the possibility of making payment orders in USD to an account in KREDOBANK SA in Ukraine.

IKO mobile banking

PKO Bank Polski SA offers modern technological solutions to its customers providing them with complete, simple, functional and safe access to banking services using telephones.

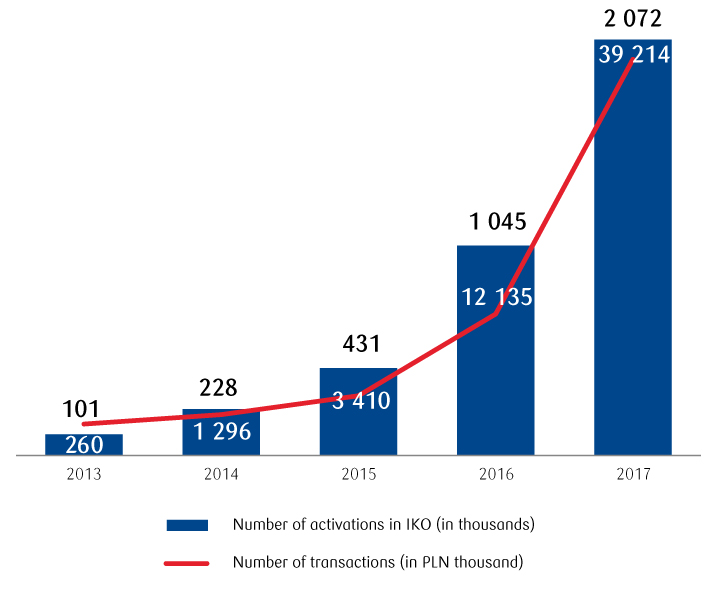

IKO is the most popular and best developed system of mobile payments in Poland. It combines the functions of mobile banking with a possibility of making mobile payments. In 2017, the total number of IKO activations exceeded 2 million and the number nearly doubled compared with 2

016. The application is constantly being enriched with new functionalities. The changes transformed IKO from an application used for mobile payments and withdrawals into an application which comprises a “bank in the phone”.

For the youngest of customers, under 13, PKO Bank Polski SA enables access to an account in the form of a mobile application PKO Junior. The application is not only convenient but also safe, additionally enhanced with functions supporting financial education and the development of an entrepreneurial attitude in a child; it is modern and intuitive and is the mobile equivalent of the PKO Junior service.

In 2017, IKO was enhanced, among other things, with:

- contactless payments for Mastercard (for Visa cards in 2016);

- payments using the BLIK code from the IKO application in offices throughout Poland;

- online shopping without a code using BLIK (BLIK One Click);

- temporary blockade of a card;

- new types of transfers: instantaneous as part of Expres Elixir, foreign, tax and from a credit card.

Apart from mobile banking and payment functions, IKO is becoming an important sales channel. In 2017, the possibility was introduced of applying for an overdraft, buying a cash loan or travel insurance. Every third cash loan in remote channels is sold via a mobile banking application.

The Polish standard of BLIK mobile payments was developed based on IKO payments. BLIK is a universal form for making payments and cash withdrawals from ATMs without using cash or a payment card, developed together with partner banks and Krajowa Izba Rozliczeniowa (Polish Clearing House). As at 31 December 2017, the mobile payment acceptance network (IKO, BLIK) amounted to more than 225 thousand devices throughout Poland (eService, First Data, PayTel, IT Card terminals). In connection with implementing the BLIK system, the IKO application currently enables withdrawals from more than 17 thousand own ATMs of PKO Bank Polski SA, Bank Millennium SA, Bank Zachodni WBK SA, ING Bank Śląski SA, Euronet ATMs (about 7 thousand) and IT Card (about 1.8 thousand).

PKO Bank Polski SA provides its customers with an option accompanying payments “Płacę z iPKO’ – for authorizing a transaction by entering the BLIK code generated in IKO. Thanks to this service, payments for shopping can be made using IKO in the majority of online shops in Poland, which are served by Dotpay, eCard, PayU, Przelewy24, Tpay.com, First Data, CashBill and Blue Media. “Płacę z iPKO” is also available in the largest Polish e-commerce auction service – Allegro.

Trusted profile in PKO Bank Polski SA

The Trusted Profile enables access to services such as ePUAP, PUE ZUS, CEIDG, obywatel.gov.pl, biznes.gov.pl and regional e-administration platforms. The Profile enables submitting an application for a personal ID card or driving licence, notify about selling a vehicle, obtain copies of birth, marriage or death certificates or to register a business. It also enables unrestricted use of all the function of the PUE ZUS service, promptly obtaining a good behaviour certificate or an individual tax interpretation. It can be also used for submitting an online application for an EKUZ card or Large Family card. It also enables the electronic signing of applications and official letters.

The Trusted Profile service was implemented in 2016, and at the end of 2017 more than 200 thousand profiles had been created in the Bank’s transaction services.

PKO Masowe Wypłaty (PKO Mass Payments) available in the ATMs of PKO Bank Polski SA

PKO Masowe Wypłaty enables payment for services in cash through three thousand of the Bank’s own ATMs. PKO Masowe Wypłaty is a service addressed to firms or institutions that perform numerous one-off cash withdrawals, which are ready to outsource this process outside their own network. The service is also offered to customers who perform repeated withdrawals on behalf of beneficiaries who do not have a bank account or prefer to receive cash.

PKO Bank Polski SA offers comprehensive banking services to firms and local government units. The execution of mass payments in ATMs is a service that has not been available on the market so far, and is an additional advantage both to the Bank’s customers and, for example, to beneficiaries of the 500+ programme.

Self-service desks

In 2017, the first self-service points were made available by PKO Bank Polski SA to customers for their convenience: two in Warsaw and two in Jelenia Góra.

The self-service desks can be used by all individual and corporate customers holding cards to these bank accounts. The desks have been equipped with touchscreens and additional software which enables executing more complex transactions other than depositing and withdrawing cash. The pilot programme is carried out in two stages. To start with, the customers may avail themselves of the function of cash payment to their own account, cash withdrawal, transfer between own accounts, transfer to any account, setting up a deposit, checking or printing out the account balance and other transactions currently available in ATMs. Next, the customers will be able to obtain a cash loan, make cash payments to other accounts, make transfers to the tax office or ZUS and open a savings account. The list of available transactions will be successively enlarged.

PKO Bank Polski SA Contact Centre

The PKO Bank Polski SA Contact Centre (CC) plays an important role in retail segment customer service. The objective of this entity’s operations is to conduct sales of products offered by the Bank during incoming and outgoing calls and to provide efficient and effective customer service, using remote communication.

PKO Bank Polski SA’s hotline employs several hundred consultants who remain at the customers’ disposal 24 hours a day. The consultants not only handle telephone calls but also answer the customers’ questions in an electronic form – e-mails and website applications. Customers may also send messages in the iPKO or Inteligo transaction service and through a special Facebook tab.

In 2017, CC remained an unquestioned service leader in the banking sector. In the 15th edition of hotline surveys conducted by ARC Rynek i Opinia, consultants from PKO Bank Polski SA obtained the highest score in nearly all of the categories examined. Pollsters who played the role of potential customers have assessed the service highly in technical terms, quality of service and the competencies of PKO Bank Polski SA consultants, including their professionalism, good manners and commitment. The general assessment of a telephone call was 9.8/10 points, which was due to best knowledge of the products among the banks examined. CC obtained equally high ratings in the examination of email contact, among other things, for the fastest responding time. The consultants of PKO Bank Polski SA answered customers’ questions within one hour, with the average for all the banks exceeding 13.5 hours.